If you’re planning to fly with United Airlines, you may be wondering about their travel insurance options. With various plans and benefits available, it can be overwhelming to understand what’s covered and what’s not. In this guide, we’ll break down United Airlines travel insurance and help you decide which plan is right for you. So sit back, relax, and let’s dive into the world of travel insurance with United Airlines.

Contents

- United Airlines Travel Insurance: Understanding Your Options and Benefits

- Frequently Asked Questions

- What is United Airlines travel insurance?

- How do I purchase United Airlines travel insurance?

- What are the benefits of United Airlines travel insurance?

- What events are covered by United Airlines travel insurance?

- What is the claims process for United Airlines travel insurance?

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

United Airlines Travel Insurance: Understanding Your Options and Benefits

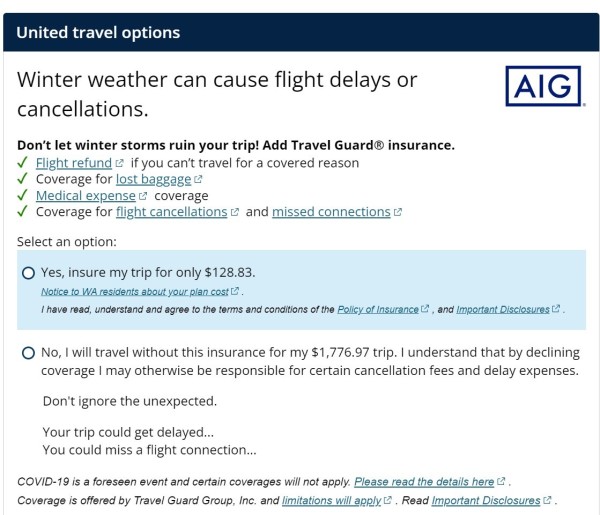

If you’re planning to travel with United Airlines, you might want to consider purchasing travel insurance to protect your trip. United Airlines offers several travel insurance options that can provide coverage for unexpected events that can disrupt your travel plans.

Types of Travel Insurance Offered by United Airlines

United Airlines offers two types of travel insurance: Trip Protection and Trip Protection Plus. Trip Protection covers the cost of your trip if you have to cancel or interrupt your trip for a covered reason, such as illness, injury, or death. It also includes baggage protection, trip delay coverage, and emergency medical and dental coverage.

Trip Protection Plus includes all the benefits of Trip Protection and adds coverage for pre-existing medical conditions, emergency medical transportation, and accidental death and dismemberment coverage.

Benefits of United Airlines Travel Insurance

United Airlines travel insurance provides a range of benefits that can give you peace of mind when you’re on the go. Some of the benefits of United Airlines travel insurance include:

- Trip cancellation and interruption coverage

- Baggage protection

- Trip delay coverage

- Emergency medical and dental coverage

- Pre-existing medical conditions coverage (Trip Protection Plus only)

- Emergency medical transportation coverage (Trip Protection Plus only)

- Accidental death and dismemberment coverage (Trip Protection Plus only)

United Airlines Travel Insurance vs. Other Travel Insurance Options

While United Airlines travel insurance offers a range of benefits, it’s important to compare it to other travel insurance options to determine which is best for you. Some factors to consider when comparing travel insurance options include:

- Coverage: What events and situations are covered by the policy?

- Cost: How much does the policy cost?

- Exclusions: Are there any situations that are not covered by the policy?

- Limits: Are there any limits to the coverage?

How to Purchase United Airlines Travel Insurance

You can purchase United Airlines travel insurance when you book your flight online or by phone. The cost of the insurance will depend on the cost of your trip and the type of coverage you choose. You can also purchase travel insurance from other providers, such as Allianz or Travel Guard.

Important Things to Know About United Airlines Travel Insurance

Before you purchase United Airlines travel insurance, it’s important to understand the terms and conditions of the policy. Here are some important things to know:

- United Airlines travel insurance only covers events that are listed in the policy.

- You may need to provide documentation to support your claim.

- You must purchase the insurance within a certain timeframe after booking your trip.

- Certain events, such as war or acts of terrorism, are not covered by the policy.

Conclusion

United Airlines travel insurance can provide valuable protection for your trip, but it’s important to understand your options and the benefits of each policy. By comparing United Airlines travel insurance to other travel insurance options and understanding the terms and conditions of the policy, you can make an informed decision about whether to purchase travel insurance for your next trip.

Frequently Asked Questions

What is United Airlines travel insurance?

United Airlines travel insurance is an optional add-on to your flight booking that provides coverage for certain unforeseen events that may occur before or during your trip. This insurance can help protect you financially and provide peace of mind while traveling.

The coverage options vary depending on the plan you choose, but typically include trip cancellation/interruption, emergency medical expenses, baggage loss/delay, and travel accident insurance.

How do I purchase United Airlines travel insurance?

You can purchase United Airlines travel insurance when you book your flight online or by calling United Airlines customer service. The cost of the insurance will vary depending on the coverage options you select and the length of your trip.

It’s important to note that travel insurance must be purchased before the unforeseen event occurs. Once an event has happened, it is too late to purchase insurance to cover it.

What are the benefits of United Airlines travel insurance?

United Airlines travel insurance provides a number of benefits to travelers, including protection against financial loss due to trip cancellation/interruption, emergency medical expenses, baggage loss/delay, and travel accident insurance. Additionally, having travel insurance can provide peace of mind and help alleviate stress while traveling.

The specific benefits and coverage options will vary depending on the plan you choose, so it’s important to review the details carefully before purchasing.

What events are covered by United Airlines travel insurance?

The events covered by United Airlines travel insurance will vary depending on the plan you choose. However, common events that are typically covered include trip cancellation/interruption due to a covered reason (such as illness, injury, or severe weather), emergency medical expenses, baggage loss/delay, and travel accident insurance.

It’s important to review the details of your specific plan to understand exactly what events are covered and to make sure that the coverage meets your needs.

What is the claims process for United Airlines travel insurance?

If you need to file a claim for United Airlines travel insurance, you will need to contact the insurance provider directly. The claims process will vary depending on the specific insurance plan you have and the type of claim you are filing.

In general, you will need to provide documentation to support your claim, such as medical records or proof of trip cancellation. It’s important to follow the claims process carefully and provide all required documentation to ensure that your claim is processed as quickly and efficiently as possible.

In conclusion, understanding your options and benefits when it comes to United Airlines travel insurance is crucial for any traveler. By taking the time to research and compare plans, you can ensure that you have the coverage you need for a worry-free trip.

One of the main benefits of United Airlines travel insurance is the flexibility it offers. With different plans to choose from, you can find one that fits your budget and travel needs, whether you’re taking a short domestic flight or a longer international trip.

Overall, United Airlines travel insurance can provide peace of mind and protection against unexpected events. By investing in a plan that suits you, you can focus on enjoying your trip and creating lasting memories without worrying about what might happen.