American Airlines, one of the largest airlines in the world, has been making headlines lately due to the pandemic’s impact on the airline industry. Investors and traders alike are keeping an eye on the company’s stocks to see how they are performing in these uncertain times.

If you’re curious about the current value of American Airlines stocks, you’ve come to the right place. In this article, we’ll explore the factors that influence the price of American Airlines stocks and give you an idea of what to expect if you’re thinking of investing in this airline giant. So, let’s take a closer look at how much American Airlines stocks are worth.

Contents

- How Much is American Airline Stocks?

- Frequently Asked Questions

- What are American Airline Stocks?

- How do I buy American Airline Stocks?

- What factors affect the price of American Airline Stocks?

- What is the current price of American Airline Stocks?

- Is investing in American Airline Stocks a good idea?

- American Airlines stock plummets on warning of rising fuel, labor costs

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

How Much is American Airline Stocks?

American Airlines is one of the largest airlines in the world. With a market capitalization of over $5 billion, it is a significant player in the aviation industry. The company’s stock is publicly traded, and investors and traders alike have shown an interest in American Airlines stock. In this article, we will explore the current state of American Airlines stock and factors that may affect its price.

Current State of American Airlines Stock

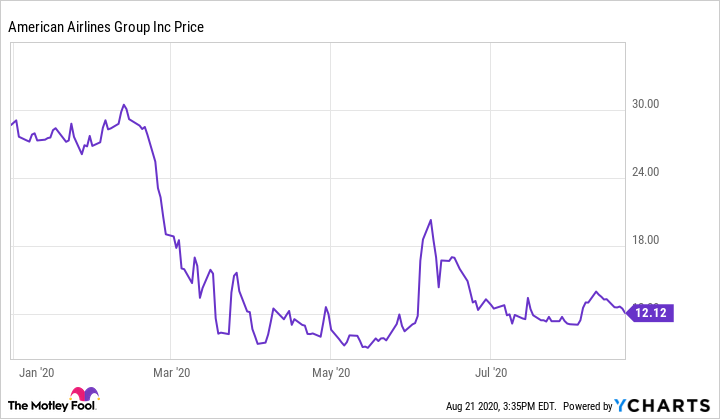

American Airlines stock is traded on the NASDAQ under the ticker symbol AAL. As of August 2021, the stock is trading at around $19 per share. This is a significant decrease from its pre-pandemic price of around $30 per share, but an improvement from its low of around $8 per share in March 2020.

The COVID-19 pandemic has had a significant impact on American Airlines stock. The airline industry as a whole has been hit hard by the pandemic, and American Airlines is no exception. However, with the rollout of vaccines and the easing of travel restrictions, the airline industry is slowly recovering. This recovery is reflected in the recent increase in American Airlines stock price.

Factors Affecting American Airlines Stock Price

Several factors can affect the price of American Airlines stock. Here are some of the most notable:

Industry Trends

The airline industry is highly competitive, and trends within the industry can affect American Airlines stock. For example, if other airlines are reporting strong earnings, this could lead to an increase in investor confidence in the industry as a whole, which could benefit American Airlines stock.

Oil Prices

Fuel costs are a significant expense for airlines, and oil prices can have a significant impact on American Airlines’ bottom line. If oil prices rise, this could lead to a decrease in American Airlines stock price as investors anticipate lower profits.

Regulatory Changes

Changes in regulations can also affect American Airlines stock. For example, if the government were to impose new taxes or fees on airlines, this could lead to a decrease in American Airlines stock price.

Benefits of Investing in American Airlines Stock

Despite the challenges facing the airline industry, there are still some potential benefits to investing in American Airlines stock. Here are a few:

Dividends

American Airlines currently pays a dividend to its shareholders. This means that investors can earn a regular income from their investment in the company.

Growth Potential

As the airline industry recovers from the pandemic, there may be growth opportunities for American Airlines. If the company can successfully adapt to changing industry conditions, this could lead to an increase in stock price.

American Airlines Stock vs. Competitors

American Airlines is not the only publicly traded airline. Here is a comparison of American Airlines stock to some of its competitors:

| Airline | Stock Price (August 2021) | Market Capitalization |

|---|---|---|

| American Airlines | $19 | $5.1 billion |

| Delta Airlines | $40 | $25.4 billion |

| United Airlines | $45 | $14.7 billion |

As you can see, American Airlines stock is currently trading at a lower price than its competitors. This could make it an attractive investment opportunity for some investors.

Conclusion

American Airlines stock is currently trading at around $19 per share, reflecting the challenges facing the airline industry due to the COVID-19 pandemic. However, as the industry recovers, there may be potential growth opportunities for the company. Investors should keep an eye on factors such as industry trends, oil prices, and regulatory changes that could affect American Airlines stock price. Overall, American Airlines stock may be an attractive investment opportunity for those looking for dividend income or growth potential in the airline industry.

Frequently Asked Questions

Here are some frequently asked questions about American Airline Stocks:

What are American Airline Stocks?

American Airline Stocks are shares of ownership in American Airlines, one of the largest airlines in the world. When you buy a share of American Airline stock, you are buying a small piece of the company and become a part-owner of the airline.

The value of American Airline Stocks is determined by the demand from buyers and sellers, as well as the company’s financial performance and overall market conditions.

How do I buy American Airline Stocks?

To buy American Airline Stocks, you need to open a brokerage account with a reputable online broker. Once you have funded your account, you can search for American Airlines stock and place an order to buy shares.

It’s important to do your research on the company and the stock before you invest to ensure it aligns with your financial goals and risk tolerance.

What factors affect the price of American Airline Stocks?

The price of American Airline Stocks is influenced by many factors, including the performance of the airline industry as a whole, economic conditions, fuel prices, and the company’s financial performance.

Other factors that can impact the stock price include changes in leadership, mergers and acquisitions, and news events that affect the company or the industry.

What is the current price of American Airline Stocks?

The current price of American Airline Stocks can fluctuate frequently due to market conditions and demand from buyers and sellers. As of [insert date], the current price of American Airlines stock is [insert price].

It’s important to note that stock prices can change quickly and investors should monitor their investments and make informed decisions based on their individual financial goals.

Is investing in American Airline Stocks a good idea?

Investing in American Airline Stocks can be a good idea for some investors, but it’s important to do your research and consider your financial goals and risk tolerance before investing.

Like all investments, there are risks associated with buying American Airline Stocks. Factors such as economic conditions, industry performance, and company financials can impact the value of the stock. It’s important to consult with a financial advisor and make informed decisions based on your individual circumstances.

American Airlines stock plummets on warning of rising fuel, labor costs

In conclusion, investing in American airline stocks can be a smart move for those interested in the aviation industry. However, it’s important to understand that stock prices can fluctuate based on a variety of factors such as economic conditions, competition, and even unforeseen events like natural disasters or pandemics.

While it’s difficult to predict the future of American airline stocks, it’s always a good idea to stay informed and keep an eye on market trends. By doing so, investors can make informed decisions about when to buy, sell, or hold onto their shares.

Ultimately, investing in American airline stocks can be a great way to diversify your investment portfolio and potentially earn a solid return on your investment. But like any investment, it comes with risks and requires careful consideration and research before jumping in.