Delta Airlines is one of the leading airlines in the world today, known for its excellent service and reliability. However, many investors are interested in the price of Delta Airlines stock, as it can be a lucrative investment opportunity. If you’re curious about how much Delta Airlines stock is currently worth, you’ve come to the right place! In this article, we will explore the current value of Delta Airlines stock and what factors can affect its price. So, let’s get started!

Contents

- How Much is Delta Airlines Stock?

- Frequently Asked Questions

- What is the current stock price of Delta Airlines?

- What has been the historical performance of Delta Airlines stock?

- What factors can impact the stock price of Delta Airlines?

- How can I purchase Delta Airlines stock?

- What are the potential risks and rewards of investing in Delta Airlines stock?

- Delta Air Lines’ fourth-quarter profit and revenue topped analysts’ expectations

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

How Much is Delta Airlines Stock?

Delta Airlines is one of the world’s largest airlines, and it’s stock is one of the most widely traded in the world. If you’re interested in investing in Delta Airlines, you’ll want to know how much the stock is currently trading for. In this article, we’ll take a look at the current price of Delta Airlines stock, as well as some of the factors that can influence its value.

Current Stock Price

As of the time of writing, Delta Airlines stock is trading at $41.96 per share. This represents a significant increase over the past year, as the stock has risen from a low of $19.10 in March 2020. However, it’s worth noting that the stock has experienced some volatility in recent months, and its value can fluctuate based on a variety of factors.

One of the key factors that can influence the value of Delta Airlines stock is the overall performance of the airline industry. If other airlines are performing well, it’s likely that investors will be more bullish on Delta Airlines as well. Similarly, any negative news related to the airline industry as a whole can cause Delta Airlines stock to decline in value.

Factors That Influence Delta Airlines Stock

In addition to the overall performance of the airline industry, there are a number of other factors that can influence the value of Delta Airlines stock. One of the most important is the company’s financial performance. If Delta Airlines is generating strong profits and revenue, investors will be more likely to buy the stock. Conversely, if the company is struggling financially, the stock may decline in value.

Another factor that can influence Delta Airlines stock is the price of oil. As a major airline, Delta is heavily dependent on oil for its operations. If the price of oil rises, it can put pressure on the company’s profits and cause the stock to decline. Conversely, if oil prices fall, Delta Airlines stock may rise.

Benefits of Investing in Delta Airlines Stock

There are a number of potential benefits to investing in Delta Airlines stock. For one, the airline industry is expected to continue growing in the coming years, which could lead to increased demand for Delta’s services. Additionally, Delta Airlines has a strong reputation for customer service, which could help it to maintain a loyal customer base even in the face of increased competition.

Another potential benefit of investing in Delta Airlines stock is the company’s dividend. Delta currently pays a quarterly dividend of $0.40 per share, which represents a yield of around 3.8%. This could provide a steady source of income for investors, even if the stock’s value doesn’t appreciate significantly.

Delta Airlines Stock vs. Competitors

Finally, it’s worth comparing Delta Airlines stock to some of its competitors in the airline industry. One of Delta’s biggest competitors is United Airlines, which is currently trading at around $51 per share. Another major competitor is American Airlines, which is trading at around $20 per share.

When comparing Delta Airlines to its competitors, it’s important to look at factors like financial performance, customer satisfaction, and growth potential. While Delta Airlines may not be the cheapest stock on the market, it does have a number of strengths that could make it an attractive investment for the long-term.

Conclusion

In conclusion, Delta Airlines stock is currently trading at $41.96 per share. While the stock has experienced some volatility in recent months, it has also seen significant growth over the past year. If you’re considering investing in Delta Airlines, it’s important to consider factors like the overall performance of the airline industry, the company’s financial performance, and the potential benefits of investing in the stock. With careful research and analysis, you may be able to make a smart investment decision that pays off in the long run.

Frequently Asked Questions

What is the current stock price of Delta Airlines?

As of [insert date], Delta Airlines stock is trading at [insert stock price]. The stock price can fluctuate based on a variety of factors, including market conditions and company performance.

If you are interested in investing in Delta Airlines stock, it is important to do your research and consider the potential risks and rewards of investing in any stock.

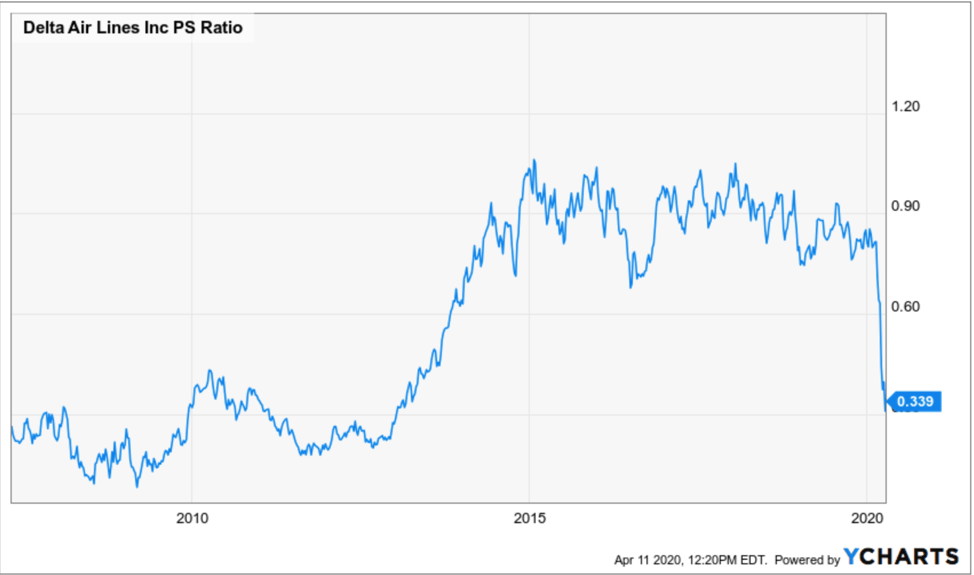

What has been the historical performance of Delta Airlines stock?

The historical performance of Delta Airlines stock can be tracked through its price history and financial reports. Over the past [insert number] years, Delta Airlines stock has [increased/decreased] by [insert percentage]. However, past performance is not a guarantee of future results.

Before investing in Delta Airlines stock, it is important to review the company’s financial reports, market trends, and other relevant information to make an informed decision.

What factors can impact the stock price of Delta Airlines?

The stock price of Delta Airlines can be impacted by a variety of factors, including changes in the economy, industry trends, and company performance. For example, if Delta Airlines reports strong financial results, the stock price may increase. Conversely, if the company reports poor results or faces challenges such as increased competition, the stock price may decrease.

Other external factors, such as changes in government regulations or geopolitical events, can also impact the stock price of Delta Airlines and other companies in the airline industry.

How can I purchase Delta Airlines stock?

To purchase Delta Airlines stock, you will need to open a brokerage account with a reputable brokerage firm. You can then place an order to buy Delta Airlines stock through your brokerage account. It is important to research the fees, commissions, and other costs associated with buying and selling stocks through a brokerage account.

Keep in mind that investing in any stock involves risks, and it is important to carefully consider your investment goals, risk tolerance, and other factors before making any investment decisions.

What are the potential risks and rewards of investing in Delta Airlines stock?

Investing in Delta Airlines stock, like any investment, involves potential risks and rewards. On the one hand, if Delta Airlines performs well and the stock price increases, investors could potentially see significant returns on their investment.

On the other hand, there are a number of risks to consider, such as changes in the economy or industry trends that could impact the airline industry as a whole, or company-specific risks such as increased competition or poor financial performance. It is important to carefully consider these risks before making any investment decisions.

Delta Air Lines’ fourth-quarter profit and revenue topped analysts’ expectations

In conclusion, investing in Delta Airlines stock can be a great financial opportunity for those interested in the aviation industry. As of [insert date], the stock was priced at [insert current price], making it an affordable option for many investors. However, it’s important to note that stock prices are subject to fluctuation, so it’s important to do your research and monitor market trends before making any investment decisions.

Overall, Delta Airlines has a long-established reputation in the industry and has consistently shown growth and profitability over the years. With its commitment to customer satisfaction and innovative technology, Delta Airlines is poised for success in the future. As a potential investor, it’s important to consider not just the current stock price, but also the company’s overall performance and potential for growth.

In summary, while the current stock price of Delta Airlines may be a key factor in your investment decision, it’s important to also consider the company’s financial performance, industry trends, and long-term potential. By doing your research and seeking the advice of financial experts, you can make informed decisions about your investments and potentially reap the benefits of a successful investment in Delta Airlines stock.