American Airlines is one of the world’s largest airlines, providing travel services to over 350 destinations in more than 50 countries. With the world slowly returning to normal, investors are curious if American Airlines stock is a buy or not.

The airline industry took a severe hit during the pandemic, but with the vaccine rollout and travel restrictions easing, the industry is expected to make a comeback. This article will examine American Airlines stock and explore whether it is a wise investment decision for investors looking to capitalize on the industry’s recovery.

Contents

- Is American Airline Stock a Buy?

- Frequently Asked Questions

- What are the current market trends for American Airline stock?

- What are some of the potential risks associated with investing in American Airline stock?

- What are some of the potential benefits of investing in American Airline stock?

- What are some of the factors that could impact the future growth of American Airline stock?

- What should investors consider before buying American Airline stock?

- American Airlines stock plummets on warning of rising fuel, labor costs

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

Is American Airline Stock a Buy?

American Airlines is one of the largest and most recognized airlines in the world. Its stock has been a hot topic of discussion among investors, with many wondering whether it is a good buy. In this article, we will examine the current state of American Airlines and whether it is worth investing in its stock.

Overview of American Airlines

American Airlines is a major airline based in the United States, with a fleet of over 950 aircraft and a route network covering over 50 countries. It is a member of the Oneworld alliance and has partnerships with several other airlines. American Airlines operates out of ten hubs across the country, with the largest being Dallas/Fort Worth International Airport.

The airline industry is known for its cyclical nature, with profits and losses often depending on factors such as fuel prices, competition, and global events. American Airlines has faced its share of challenges, including bankruptcy in 2011. However, it has since rebounded and has been profitable in recent years.

Financial Performance

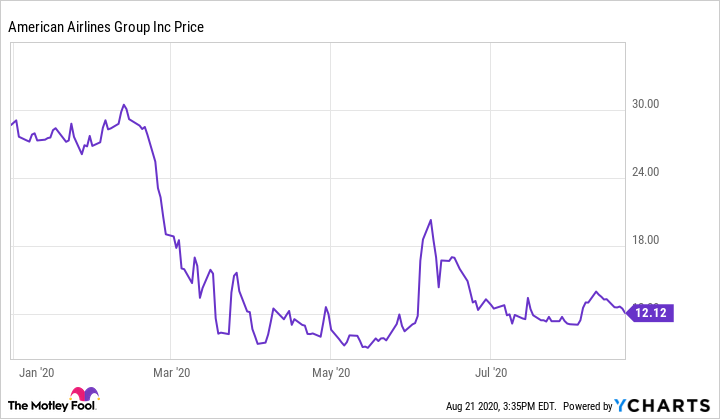

When considering whether to invest in a company’s stock, financial performance is a crucial factor to examine. American Airlines reported a net loss of $2.2 billion in 2020, largely due to the COVID-19 pandemic’s impact on the travel industry. However, the company has taken steps to reduce costs and increase liquidity, including securing loans and issuing bonds.

Despite the challenges, American Airlines has a strong balance sheet, with a debt-to-equity ratio of 3.81 and a current ratio of 0.64. The company also has a market capitalization of over $12 billion and a dividend yield of 0.4%.

Competitive Landscape

The airline industry is highly competitive, with several major players vying for market share. American Airlines faces stiff competition from other legacy carriers such as Delta and United, as well as low-cost carriers like Southwest and JetBlue.

To stay competitive, American Airlines has focused on improving its customer experience, including investing in new aircraft and upgrading its existing fleet. The company has also expanded its route network and formed partnerships with other airlines to offer more travel options to customers.

Risks and Challenges

Investing in any stock comes with risks, and American Airlines is no exception. Some of the major risks and challenges facing the company include:

- The ongoing impact of the COVID-19 pandemic on the travel industry

- Elevated fuel prices, which can impact the company’s bottom line

- Competition from other airlines, which can lead to pricing pressures

- Regulatory changes and geopolitical risks, which can impact the airline industry as a whole

Investors should carefully consider these risks before investing in American Airlines stock.

Conclusion

Overall, American Airlines is a well-established airline with a strong market position and a solid financial foundation. However, the ongoing impact of the pandemic and other risks facing the airline industry make it a somewhat risky investment. Investors who are willing to take on some risk and have a long-term investment horizon may find American Airlines stock to be a good buy.

Frequently Asked Questions

Here are some common questions and answers regarding American Airline stock and its potential as a buy:

What are the current market trends for American Airline stock?

The current market trends for American Airline stock are mixed. While the company has seen some positive growth in recent years, it has also faced challenges such as rising fuel costs and increased competition. Additionally, the COVID-19 pandemic has had a significant impact on the airline industry as a whole, which has affected the stock prices of many airlines including American Airlines.

Despite these challenges, some analysts believe that American Airlines could still be a good long-term investment, especially if the company is able to successfully navigate the current economic climate and capitalize on trends such as increased travel demand as the pandemic subsides.

What are some of the potential risks associated with investing in American Airline stock?

There are several potential risks associated with investing in American Airlines stock. One of the biggest risks is the volatility of the airline industry, which is subject to a wide range of factors such as fuel prices, weather conditions, and global economic trends. Additionally, the COVID-19 pandemic has had a significant impact on the airline industry, and it is unclear how long it will take for the industry to fully recover.

Other potential risks include increased competition from other airlines and the potential for regulatory changes or other external factors that could impact the industry as a whole. As with any investment, it is important to carefully consider the potential risks before making a decision to invest in American Airlines stock.

What are some of the potential benefits of investing in American Airline stock?

There are several potential benefits of investing in American Airlines stock. For one, the company has a strong brand and a large customer base, which could help it to weather economic downturns and other challenges. Additionally, American Airlines has been investing in new technologies and other initiatives designed to improve efficiency and enhance the customer experience, which could help it to remain competitive in the long run.

Finally, American Airlines has also been working to reduce its debt and improve its financial position, which could make it a more attractive investment opportunity for those looking for a stable, long-term investment in the airline industry.

What are some of the factors that could impact the future growth of American Airline stock?

Several factors could impact the future growth of American Airlines stock. One of the biggest factors is the ongoing impact of the COVID-19 pandemic on the airline industry. While travel demand is expected to pick up again as the pandemic subsides, it is unclear how long it will take for the industry to fully recover, and what the long-term impact of the pandemic will be on consumer behavior and travel trends.

Other factors that could impact the future growth of American Airlines stock include changes in fuel prices, increased competition from other airlines, and potential regulatory changes or other external factors that could impact the industry as a whole.

What should investors consider before buying American Airline stock?

Before investing in American Airlines stock, investors should carefully consider a range of factors, including the current market trends for the airline industry, the potential risks and benefits of investing in American Airlines specifically, and their own financial goals and risk tolerance.

It is important to conduct thorough research and analysis, and to consult with a financial advisor or other investment professional to help assess the potential risks and benefits of investing in American Airlines stock, and to determine whether it is a good fit for their investment portfolio and financial goals.

American Airlines stock plummets on warning of rising fuel, labor costs

In conclusion, the question of whether American Airline stock is a buy is a complex one. There are many factors to consider, including the current state of the airline industry, the company’s financial performance, and the overall economic outlook.

On the one hand, American Airlines has shown resilience in the face of the pandemic and has taken steps to improve its financial position. It has also benefited from government aid and could potentially see further gains if travel demand rebounds.

On the other hand, there are still many uncertainties surrounding the airline industry, and competition is fierce. Additionally, the stock price has already seen significant gains, so investors should be cautious about overpaying for shares.

Overall, investors should carefully weigh the risks and potential rewards before making a decision about whether to buy American Airline stock. While there are reasons to be optimistic, there are also plenty of challenges that the company will need to overcome in the coming months and years.