American Airlines’ stock has been making headlines today as it experiences a significant boost in value. Many investors are curious about the reason behind this sudden surge in stocks. With the airline industry being heavily impacted by the ongoing pandemic, any positive news for American Airlines is worth exploring.

One possible explanation for the increase in American Airlines’ stock could be the recent announcement of the vaccine rollout plan. With the hope of a return to normalcy, investors may be feeling more confident in the airline industry’s future prospects. Additionally, the recent news of a stimulus package may also be contributing to the positive sentiment towards American Airlines’ stock. Let’s dive deeper into these factors to understand why American Airlines’ stock is up today.

Contents

- Why American Airlines Stock Up Today?

- Frequently Asked Questions

- What factors contributed to American Airlines’ stock increase today?

- How does the current economic climate affect American Airlines’ stock price?

- What is the overall trend of American Airlines’ stock price over the past year?

- What are some risks associated with investing in American Airlines’ stock?

- What is the outlook for American Airlines’ stock in the near future?

- American Airlines stock up premarket on earnings, guidance

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

Why American Airlines Stock Up Today?

American Airlines, one of the largest airlines in the world, saw a significant boost in its stock price today. This sudden surge in stock price has left many investors wondering what has caused this increase and whether it is sustainable. In this article, we will explore the reasons behind American Airlines’ stock price increase and the potential benefits it may bring.

1. Increase in Travel Demand

The global travel industry has been hit hard by the COVID-19 pandemic, with many airlines struggling to stay afloat. However, with the rollout of vaccines and the gradual reopening of economies, there has been a significant increase in travel demand. American Airlines has seen a surge in bookings, especially for domestic flights, which has boosted its revenue and ultimately its stock price.

Moreover, with the recent announcement of the CDC’s eased travel restrictions, the demand for air travel is expected to increase further. This increase in demand is a positive sign for American Airlines and other airlines, which have been struggling due to the pandemic.

2. Better Financial Performance

Another reason for the increase in American Airlines’ stock price is its better-than-expected financial performance. The airline recently reported its first-quarter earnings, which surpassed analysts’ expectations. The company reported revenue of $4 billion, which is a significant improvement from the same period last year.

Moreover, American Airlines has been successful in cutting costs and improving its operational efficiency, which has resulted in higher profits. Investors are optimistic about the company’s financial performance and are showing confidence in its future growth potential.

3. Government Aid

American Airlines, like many other airlines, received government aid as part of the COVID-19 relief package. The airline received $5.8 billion in payroll support, which helped it to weather the storm of the pandemic. This government aid has provided a much-needed lifeline to the airline industry and has helped to stabilize it.

Moreover, with the recent announcement of the Biden administration’s infrastructure plan, there is hope that the airline industry will receive further government support. This news has been positively received by investors, who see it as a potential catalyst for further growth in the industry.

4. Competitor Performance

Another factor that has contributed to the increase in American Airlines’ stock price is its competitor’s performance. Delta, United, and Southwest, which are American Airlines’ main competitors, have also seen a surge in their stock prices. This increase in stock prices has been attributed to the increase in travel demand and better financial performance.

Investors are optimistic about the airline industry’s recovery and are investing in multiple airlines, including American Airlines. This optimism has contributed to the increase in American Airlines’ stock price.

5. Benefits of Investing in American Airlines

Investing in American Airlines has its benefits. The airline has a broad network of destinations, making it a preferred choice for travelers. Moreover, the airline has been successful in cutting costs and improving its operational efficiency, which has resulted in higher profits.

Furthermore, with the increase in travel demand, American Airlines is expected to see a further boost in revenue, which will ultimately benefit its investors. Investing in American Airlines is a good choice for investors looking for growth potential in the airline industry.

6. American Airlines vs. Competitors

Compared to its competitors, American Airlines has its strengths and weaknesses. One of its strengths is its broad network of destinations, which gives it a competitive edge. Moreover, the airline has been successful in cutting costs and improving its operational efficiency, which has resulted in higher profits.

However, American Airlines also has its weaknesses. It has a significant debt burden, which may limit its ability to invest in growth initiatives. Moreover, the airline has had a history of labor disputes, which can negatively impact its operations.

7. Risks of Investing in American Airlines

Investing in American Airlines comes with its risks. The airline industry is highly cyclical, and the demand for air travel can fluctuate significantly. Moreover, the airline has a significant debt burden, which may limit its ability to invest in growth initiatives.

Furthermore, American Airlines is exposed to geopolitical risks, such as global conflicts and terrorism, which can disrupt its operations. Investors should carefully consider these risks before investing in American Airlines.

8. Future Growth Potential

Despite the risks, American Airlines has a significant growth potential. The airline has a broad network of destinations, which gives it a competitive edge. Moreover, with the increase in travel demand, American Airlines is expected to see a further boost in revenue.

Furthermore, with the gradual reopening of economies, there is hope that international travel will resume, which will benefit American Airlines. The airline has also been investing in technology and digital initiatives, which will improve its operational efficiency and customer experience.

9. Conclusion

In conclusion, American Airlines’ stock price increase is attributed to the increase in travel demand, better financial performance, government aid, competitor performance, and investor optimism. Investing in American Airlines has its benefits, such as its broad network of destinations and improved operational efficiency.

However, investing in American Airlines also comes with its risks, such as the highly cyclical nature of the airline industry and significant debt burden. Investors should carefully consider these risks before investing in American Airlines. Nevertheless, American Airlines has a significant growth potential, and investors looking for growth potential in the airline industry should consider investing in it.

10. References

- https://www.cnbc.com/2021/04/22/american-airlines-aal-earnings-q1-2021.html

- https://www.reuters.com/business/aerospace-defense/airlines-hail-us-cdc-easing-travel-guidance-vaccinated-people-2021-04-02/

- https://www.usatoday.com/story/travel/airline-news/2021/03/31/biden-infrastructure-plan-airlines-could-get-25-billion-boost/4822626001/

Frequently Asked Questions

What factors contributed to American Airlines’ stock increase today?

American Airlines’ stock increase today can be attributed to several factors:

1. Positive news regarding the COVID-19 vaccine development and distribution, which has led to a more optimistic outlook for the airline industry.

2. Strong financial performance and earnings reports from American Airlines, indicating a more stable and profitable future for the company.

How does the current economic climate affect American Airlines’ stock price?

The current economic climate can have a significant impact on American Airlines’ stock price. Factors such as the state of the global economy, geopolitical events, and changes in consumer behavior can all influence the demand for air travel and, consequently, the stock price of airline companies like American Airlines.

Additionally, fluctuations in fuel prices, labor costs, and other expenses can affect the profitability of the company, which can also impact its stock price.

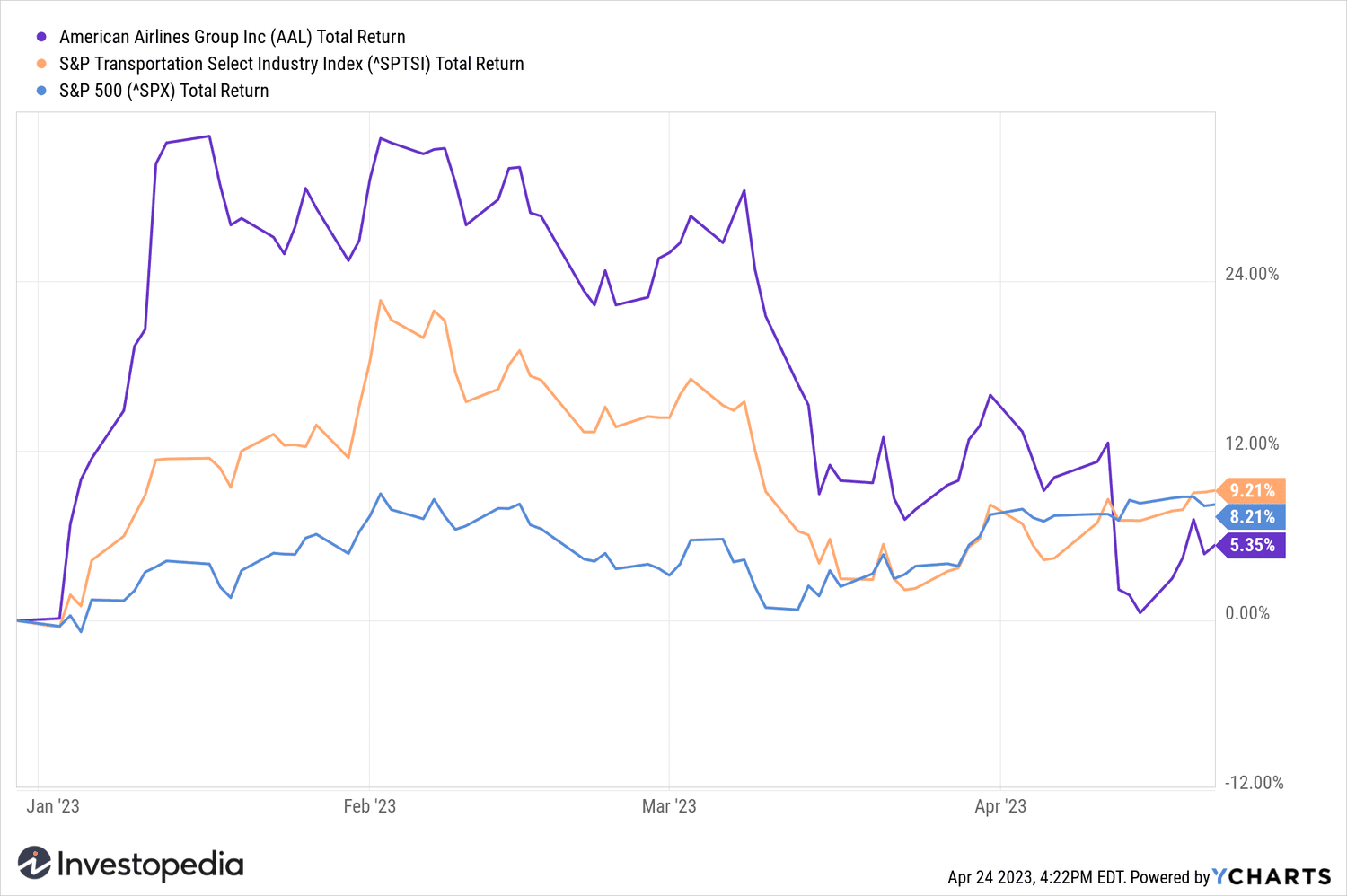

What is the overall trend of American Airlines’ stock price over the past year?

The overall trend of American Airlines’ stock price over the past year has been volatile. The COVID-19 pandemic and its impact on the airline industry have caused significant fluctuations in the stock price, with several periods of sharp decline followed by periods of recovery.

However, there have been some positive developments in recent months, such as the vaccine rollout and the easing of travel restrictions, which have led to a more positive outlook for the airline industry and may contribute to a more stable stock price in the future.

What are some risks associated with investing in American Airlines’ stock?

Investing in American Airlines’ stock carries several risks, including:

1. The ongoing impact of the COVID-19 pandemic on the airline industry, which could lead to further declines in demand for air travel and negatively impact the company’s financial performance.

2. Competition from other airlines, which could lead to a decrease in market share and revenue.

3. Fluctuations in fuel prices, labor costs, and other expenses, which could impact the profitability of the company and, consequently, its stock price.

What is the outlook for American Airlines’ stock in the near future?

The outlook for American Airlines’ stock in the near future is positive, but uncertain. The vaccine rollout and the easing of travel restrictions are positive developments that could lead to an increase in demand for air travel and a more stable financial outlook for the company.

However, the ongoing impact of the COVID-19 pandemic, competition from other airlines, and other factors could still negatively impact the company’s stock price. As with any investment, it is important to carefully consider the risks and potential rewards before making a decision.

American Airlines stock up premarket on earnings, guidance

In conclusion, American Airlines stock has seen a surge in value today due to a few key factors. Firstly, the optimism surrounding the COVID-19 vaccine rollout has boosted investor confidence in the travel industry as a whole. Secondly, American Airlines has recently announced plans to expand their domestic and international routes, which has generated excitement and interest among investors. Finally, the airline has also taken steps to improve their financial position and reduce debt, which has also contributed to the rise in stock value.

Overall, it’s clear that American Airlines is well positioned to capitalize on the post-pandemic travel boom. With a strong focus on expansion and financial stability, the company is poised to deliver significant value to its shareholders in the coming months and years. So if you’re looking for a promising investment opportunity, American Airlines stock is definitely worth considering.