Are you planning your next adventure with United Airlines? It’s always a good idea to consider travel insurance to protect your trip from unexpected events. But what exactly does United Airlines travel insurance cover? In this article, we’ll break down the different types of coverage available and what you can expect from each.

Contents

- What Does United Airlines Travel Insurance Cover?

- 1. Trip Cancellation and Interruption Coverage

- 2. Baggage Delay Coverage

- 3. Emergency Medical and Dental Coverage

- 4. Emergency Evacuation and Repatriation Coverage

- 5. Travel Accident Coverage

- 6. 24-Hour Assistance Services

- 7. Pre-Existing Medical Conditions Coverage

- 8. Cancel for Work Reasons Coverage

- 9. Rental Car Damage Coverage

- 10. Cancel for Any Reason Coverage

- Frequently Asked Questions

- Does United Airlines travel insurance cover trip cancellations?

- What medical expenses are covered by United Airlines travel insurance?

- Does United Airlines travel insurance cover lost or delayed baggage?

- What happens if I need to cancel my trip due to COVID-19?

- Does United Airlines travel insurance cover adventure activities?

- Travel insurance: What it covers, what it doesn’t

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

What Does United Airlines Travel Insurance Cover?

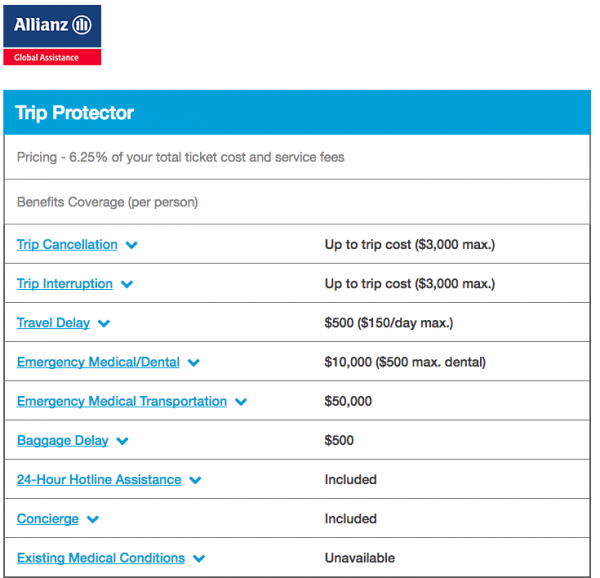

When planning a trip, it’s important to consider travel insurance to protect yourself against unexpected events that can disrupt your travel plans. United Airlines offers a range of travel insurance options that provide coverage for various situations. Here are the details on what United Airlines travel insurance covers.

1. Trip Cancellation and Interruption Coverage

Trip cancellation and interruption coverage provide reimbursement for non-refundable prepaid expenses if you have to cancel or interrupt your trip due to a covered reason. Covered reasons include illness, injury, or death of the traveler, a family member, or a traveling companion, severe weather, and other unforeseen circumstances. United Airlines travel insurance covers up to 100% of your trip cost.

If you purchase this coverage, you can cancel your trip up to 24 hours before departure for any reason. You will receive a refund of up to 75% of your trip cost.

2. Baggage Delay Coverage

If your checked baggage is delayed for a certain period of time, United Airlines travel insurance provides coverage for necessary items you need to purchase, such as clothing and toiletries. The policy covers up to $100 per day for up to three days.

3. Emergency Medical and Dental Coverage

If you become sick or injured while traveling, United Airlines travel insurance provides coverage for emergency medical and dental expenses. Coverage includes hospitalization, surgery, and emergency transportation. The policy covers up to $250,000.

4. Emergency Evacuation and Repatriation Coverage

If you become seriously ill or injured while traveling and need to be evacuated to a hospital or transported back home, United Airlines travel insurance provides coverage for these expenses. The policy covers up to $1,000,000.

5. Travel Accident Coverage

If you experience a covered accident while traveling, United Airlines travel insurance provides coverage for accidental death and dismemberment. The policy covers up to $500,000.

6. 24-Hour Assistance Services

United Airlines travel insurance provides 24-hour assistance services for emergency travel assistance, medical and legal referrals, lost baggage assistance, and emergency message relay.

7. Pre-Existing Medical Conditions Coverage

If you have a pre-existing medical condition, United Airlines travel insurance provides coverage for any related medical expenses. However, you must purchase the coverage within 14 days of your initial trip deposit.

8. Cancel for Work Reasons Coverage

If you have to cancel your trip due to work-related reasons, United Airlines travel insurance provides coverage for non-refundable prepaid expenses. Covered reasons include job loss, job transfer, and required work relocation.

9. Rental Car Damage Coverage

If you rent a car while traveling and the car is damaged or stolen, United Airlines travel insurance provides coverage for the loss or damage. The policy covers up to $50,000.

10. Cancel for Any Reason Coverage

If you purchase the Cancel for Any Reason coverage, you can cancel your trip for any reason up to 48 hours before departure. You will receive a refund of up to 75% of your trip cost.

In conclusion, United Airlines travel insurance offers a comprehensive range of coverage options to protect you against unexpected events that can disrupt your travel plans. It’s important to carefully consider the coverage you need and purchase the policy that best meets your needs.

Frequently Asked Questions

Does United Airlines travel insurance cover trip cancellations?

Yes, United Airlines travel insurance covers trip cancellations due to covered reasons such as illness, injury, or death of the traveler or a family member, a natural disaster, or a terrorist incident. However, cancellations due to reasons such as a change of mind or a work-related event may not be covered.

What medical expenses are covered by United Airlines travel insurance?

United Airlines travel insurance covers medical expenses incurred due to an illness or injury during a trip. This includes emergency medical treatment, hospital stays, and transportation to a medical facility. However, pre-existing medical conditions may not be covered under the policy.

Does United Airlines travel insurance cover lost or delayed baggage?

Yes, United Airlines travel insurance covers lost or delayed baggage up to a certain amount. The policy also covers the cost of replacing essential items in the baggage, such as medication and clothing. However, valuable items such as jewelry or electronic devices may not be covered.

What happens if I need to cancel my trip due to COVID-19?

If you need to cancel your trip due to COVID-19, United Airlines travel insurance may cover the cancellation if it meets the policy’s criteria. This includes if you or a family member contract COVID-19, you are required to quarantine, or the destination country has travel restrictions in place. However, cancellations due to fear of traveling or government advisories may not be covered.

Does United Airlines travel insurance cover adventure activities?

United Airlines travel insurance may cover adventure activities such as skiing, snowboarding, and scuba diving, but it depends on the specific policy purchased. It is important to check the policy’s terms and conditions before participating in any activities to ensure coverage. Some extreme sports or activities may not be covered under the policy.

Travel insurance: What it covers, what it doesn’t

In conclusion, United Airlines travel insurance offers a range of coverage options to ensure that travelers are protected from unexpected events that may occur before or during their trip. From trip cancellation and interruption to emergency medical and dental coverage, United Airlines has got you covered.

It is important to carefully review the terms and conditions of the insurance policy to understand the coverage limits and exclusions. Additionally, travelers should consider purchasing travel insurance as soon as they book their trip to ensure they are covered in the event of unforeseen circumstances.

Overall, United Airlines travel insurance provides peace of mind for travelers, allowing them to enjoy their trip without worrying about the unexpected. By taking advantage of the coverage options available, travelers can travel with confidence and enjoy their trip to the fullest.