Traveling can be an exciting and enriching experience, but it can also come with its own set of challenges. One of these challenges is the unpredictability of travel, which can include flight cancellations, lost luggage, and medical emergencies. That’s why it’s important to consider purchasing travel insurance, especially when flying with American Airlines.

American Airlines offers a range of travel insurance options that can provide peace of mind and protection for travelers. In this guide, we’ll explore the different types of insurance available, as well as the benefits and coverage provided by each. Whether you’re planning a domestic trip or an international adventure, understanding your insurance options can help ensure a smoother, stress-free travel experience.

Contents

- American Airlines Travel Insurance: Understanding Your Options and Benefits

- Frequently Asked Questions

- What is American Airlines Travel Insurance?

- What are the benefits of American Airlines Travel Insurance?

- How do I purchase American Airlines Travel Insurance?

- How much does American Airlines Travel Insurance cost?

- When should I purchase American Airlines Travel Insurance?

- Travel Insurance Tips: 7 Things to Know Before You Buy

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

American Airlines Travel Insurance: Understanding Your Options and Benefits

When planning a trip, it’s important to consider purchasing travel insurance. American Airlines offers different travel insurance options that can provide peace of mind and protect you from unexpected events that can disrupt your trip. In this article, we’ll discuss the different travel insurance options offered by American Airlines and the benefits they provide.

Types of American Airlines Travel Insurance

American Airlines offers two types of travel insurance, which are the Trip Cancellation and Interruption Insurance and the Travel Protection Plan.

The Trip Cancellation and Interruption Insurance provides coverage for non-refundable trip expenses such as airfare, hotel accommodations, and tour packages if you need to cancel or interrupt your trip for covered reasons such as illness, injury, or death. This insurance also provides coverage for trip delays, missed connections, and lost or stolen baggage.

The Travel Protection Plan, on the other hand, includes all the benefits of the Trip Cancellation and Interruption Insurance plus additional benefits such as emergency medical and dental coverage, emergency medical transportation, and 24/7 travel assistance services.

Benefits of American Airlines Travel Insurance

Purchasing travel insurance from American Airlines can provide several benefits, including:

- Peace of Mind: Travel insurance can provide peace of mind knowing that you are covered in case of unforeseen events that can disrupt your trip.

- Financial Protection: Travel insurance can protect you from losing money on non-refundable trip expenses if you need to cancel or interrupt your trip for covered reasons.

- Emergency Assistance: American Airlines travel insurance provides 24/7 travel assistance services that can help you with emergency medical or travel needs while on your trip.

American Airlines Travel Insurance Vs Other Travel Insurance Providers

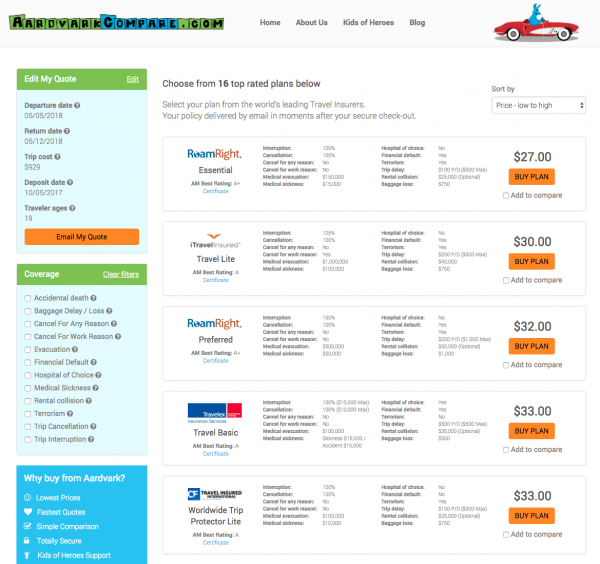

When it comes to choosing travel insurance, it’s important to compare the benefits and pricing of different providers. Here’s how American Airlines travel insurance compares to other travel insurance providers:

| Travel Insurance Provider | Benefits | Pricing |

|---|---|---|

| American Airlines | Provides coverage for non-refundable trip expenses, trip delays, missed connections, lost or stolen baggage, emergency medical and dental coverage, emergency medical transportation, and 24/7 travel assistance services. | Varies depending on the type of insurance and the length and cost of your trip. |

| Allianz Global Assistance | Provides coverage for trip cancellation, trip interruption, emergency medical and dental coverage, emergency medical transportation, and 24/7 travel assistance services. | Varies depending on the type of insurance and the length and cost of your trip. |

| World Nomads | Provides coverage for trip cancellation, trip interruption, emergency medical and dental coverage, emergency medical transportation, and adventure sports coverage. | Varies depending on the type of insurance and the length and cost of your trip. |

How to Purchase American Airlines Travel Insurance

You can purchase American Airlines travel insurance when booking your flight on the American Airlines website or by calling American Airlines reservations. You can also purchase travel insurance up to 24 hours before your trip’s departure time.

In conclusion, purchasing travel insurance from American Airlines can provide peace of mind and financial protection in case of unforeseen events that can disrupt your trip. By understanding your options and benefits, you can choose the best travel insurance that suits your needs and budget.

Frequently Asked Questions

What is American Airlines Travel Insurance?

American Airlines Travel Insurance is a type of insurance that provides coverage for unexpected events that may occur during your trip. This can include trip cancellations, medical emergencies, lost or stolen baggage, and more. By purchasing travel insurance, you can protect yourself from financial losses that may occur as a result of such events.

There are different types of travel insurance policies available, and the coverage and benefits they offer may vary. American Airlines offers travel insurance through its partner, Allianz Global Assistance, which provides different plans that you can choose from depending on your needs and preferences.

What are the benefits of American Airlines Travel Insurance?

American Airlines Travel Insurance provides various benefits that can help you enjoy a worry-free travel experience. These benefits may include trip cancellation coverage, emergency medical and dental coverage, baggage loss and delay coverage, and travel accident coverage, among others.

In addition, American Airlines Travel Insurance offers 24/7 assistance services that you can access anytime during your trip. These services can help you with emergency travel arrangements, medical referrals, language interpretation, and more.

How do I purchase American Airlines Travel Insurance?

You can purchase American Airlines Travel Insurance when you book your flight on the American Airlines website or via phone. During the booking process, you will be given the option to add travel insurance to your itinerary.

Alternatively, you can purchase travel insurance separately from your flight booking through Allianz Global Assistance’s website. Simply select the plan that suits your needs and preferences, and complete the online application form.

How much does American Airlines Travel Insurance cost?

The cost of American Airlines Travel Insurance varies depending on the type of plan you choose, the duration of your trip, and the coverage and benefits included in the policy. You can get a quote for travel insurance when you book your flight on the American Airlines website or via phone.

Alternatively, you can get a quote from Allianz Global Assistance’s website by selecting the plan you want and providing the necessary information about your trip.

When should I purchase American Airlines Travel Insurance?

It is recommended that you purchase American Airlines Travel Insurance as soon as you book your trip. This will ensure that you are covered in case of unexpected events that may occur before or during your trip.

Keep in mind that some travel insurance policies have specific time limits for purchasing coverage, so it’s important to check the details of the policy you’re interested in and purchase it within the required timeframe.

Travel Insurance Tips: 7 Things to Know Before You Buy

In conclusion, understanding your travel insurance options and benefits is crucial when flying with American Airlines. By taking the time to research and choose the right insurance plan for you, you can have peace of mind knowing that you are covered in case of unexpected events.

Whether you opt for basic coverage or more comprehensive plans, American Airlines offers various options to suit your needs and budget. From trip cancellation and interruption to emergency medical and dental coverage, you can rest assured knowing that you are protected.

Don’t let unforeseen circumstances ruin your travel plans. Take advantage of American Airlines travel insurance options today and travel with confidence knowing that you are covered every step of the way. Happy travels!