American Airlines is one of the largest airlines in the United States, operating more than 6,700 flights per day to over 50 countries worldwide. With such a prominent presence in the airline industry, many investors are curious about the current stock price of American Airlines.

If you are one of those investors, you may be wondering: how much is American Airlines stock worth? In this article, we will explore the current state of American Airlines stock and provide insights on what factors may be affecting its value. So, let’s dive in and find out more!

How Much is American Airlines Stock?

If you are interested in investing in American Airlines, you may be wondering how much its stock is worth. The value of American Airlines stock can fluctuate based on a variety of factors, including market conditions, industry trends, and company performance. In this article, we will explore the current state of American Airlines stock and what factors may be impacting its value.

Current Stock Price

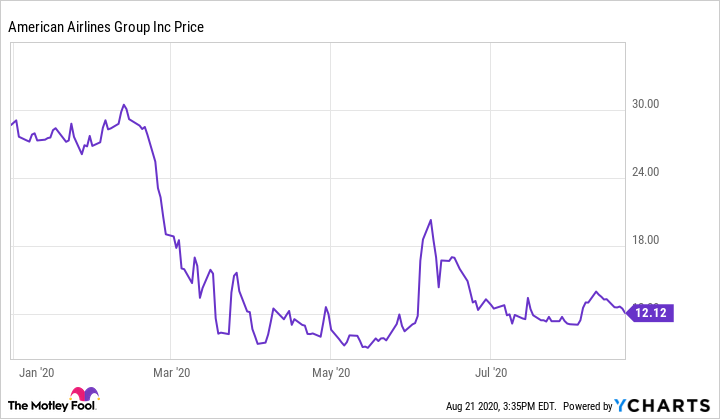

As of the time of writing, American Airlines Group Inc. (AAL) stock is trading at $19.86 per share. This price represents a decrease of 39.6% from its 52-week high of $32.02 per share and an increase of 144.8% from its 52-week low of $8.07 per share. American Airlines has a market capitalization of $12.78 billion and a price-to-earnings ratio of 5.35.

There are several factors that are currently impacting the value of American Airlines stock. One of the most significant is the COVID-19 pandemic, which has had a major impact on the airline industry as a whole. As travel restrictions and lockdowns have been imposed around the world, demand for air travel has plummeted. This has led to a significant decrease in revenue for American Airlines and other airlines, which has in turn impacted their stock prices.

Despite these challenges, there are some reasons to be optimistic about American Airlines’ future prospects. The company has taken steps to reduce its costs and improve its cash flow, which could help it weather the current crisis. Additionally, as vaccines become more widely available and travel restrictions are lifted, demand for air travel is likely to rebound, which could help boost American Airlines’ revenue and stock price.

Historical Performance

American Airlines has a long history, dating back to its founding in 1926. Over the years, the company has gone through many changes, including mergers with other airlines and bankruptcy filings. Despite these challenges, American Airlines has remained a major player in the airline industry, with a large fleet of planes and a global network of destinations.

In terms of its stock performance, American Airlines has had its ups and downs. In recent years, the company’s stock price has been impacted by a variety of factors, including rising fuel costs, labor disputes, and the COVID-19 pandemic. However, the company has also experienced periods of growth and profitability, particularly during times of economic expansion.

Benefits of Investing in American Airlines Stock

Investing in American Airlines stock can offer a number of potential benefits for investors. For one, the airline industry has historically been a major contributor to economic growth, as it enables people and goods to travel more easily and efficiently. Additionally, as travel restrictions are lifted and demand for air travel rebounds, American Airlines and other airlines could see significant revenue growth, which could translate into higher stock prices.

Another potential benefit of investing in American Airlines stock is diversification. By investing in a variety of stocks across different industries, investors can reduce their overall risk and potentially achieve higher returns over the long term. American Airlines is just one of many companies that investors can choose to invest in, but it could be a good choice for those looking to add exposure to the airline industry to their portfolio.

American Airlines Stock vs. Competitors

American Airlines is just one of many companies in the airline industry, and investors may be wondering how it stacks up against its competitors. Some of the other major players in the industry include Delta Air Lines, United Airlines, and Southwest Airlines.

In terms of stock performance, American Airlines has generally lagged behind its competitors in recent years. However, this could be due to a variety of factors, such as differences in business models, routes, and management strategies. Ultimately, the decision of whether to invest in American Airlines or one of its competitors will depend on a number of factors, including an investor’s risk tolerance, investment goals, and overall market outlook.

Conclusion

In conclusion, the current state of American Airlines stock is impacted by a variety of factors, including the COVID-19 pandemic, industry trends, and company performance. Despite these challenges, there are reasons to be optimistic about the future of American Airlines, including its efforts to reduce costs and improve cash flow, as well as the eventual rebound in demand for air travel. As with any investment, it is important to carefully consider the risks and potential rewards before investing in American Airlines stock or any other stock.

Contents

- Frequently Asked Questions

- What is American Airlines stock?

- How is the price of American Airlines stock determined?

- Can I buy American Airlines stock?

- What is the current price of American Airlines stock?

- What are the risks of investing in American Airlines stock?

- American Airlines stock plummets on warning of rising fuel, labor costs

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

Frequently Asked Questions

Find below answers to some frequently asked questions about American Airlines stock.

What is American Airlines stock?

American Airlines stock is a type of security that represents ownership in American Airlines Group Inc. When you buy American Airlines stock, you become a shareholder in the company and own a part of it. The value of your investment in American Airlines stock is determined by the stock market and can go up or down depending on various factors.

How is the price of American Airlines stock determined?

The price of American Airlines stock is determined by the supply and demand in the stock market. If there are more people buying American Airlines stock than selling it, the price will go up. If there are more people selling American Airlines stock than buying it, the price will go down. The price of American Airlines stock is also influenced by various factors such as the company’s financial performance, industry trends, and global events that affect the airline industry.

Can I buy American Airlines stock?

Yes, you can buy American Airlines stock if you have a brokerage account. You can buy American Airlines stock through a broker or an online trading platform. Before buying American Airlines stock, it’s important to do your research and understand the risks involved in investing in the stock market. You should also consider your investment goals, financial situation, and risk tolerance before buying American Airlines stock.

What is the current price of American Airlines stock?

The current price of American Airlines stock is subject to change as the stock market is constantly fluctuating. You can check the current price of American Airlines stock on financial news websites or through your brokerage account. However, it’s important to note that the stock price may not necessarily reflect the true value of the company and may be influenced by various factors that are beyond the company’s control.

What are the risks of investing in American Airlines stock?

Investing in American Airlines stock comes with various risks such as market risk, industry risk, and company-specific risk. The stock market can be volatile and unpredictable, and the price of American Airlines stock can fluctuate rapidly. The airline industry is also highly competitive and subject to various factors such as fuel prices, labor costs, and global events that can affect the company’s financial performance. Additionally, American Airlines may face company-specific risks such as management changes, lawsuits, and regulatory issues that can impact the stock price.

American Airlines stock plummets on warning of rising fuel, labor costs

In conclusion, the price of American Airlines stock is an ever-changing figure that is influenced by a variety of factors such as market trends, company performance, and global events. As of [insert date], the stock was trading at [insert price], but it is important to remember that this is subject to change at any time.

Investing in the stock market can be a risky venture, but with the right knowledge and guidance, it can also be a lucrative one. Before investing in American Airlines stock, it is important to do your research and consult with a financial advisor to ensure that it aligns with your investment goals and risk tolerance.

Overall, whether you are a seasoned investor or just starting out, keeping an eye on the price of American Airlines stock can provide valuable insights into the health of the company and the aviation industry as a whole. Stay informed, stay cautious, and happy investing!