American Airlines is one of the largest and most recognizable airlines in the world. If you’re considering investing in this airline, you’re likely wondering if it’s a good choice. With its strong brand and impressive fleet, American Airlines certainly has a lot going for it. However, there are also potential risks to be aware of. In this article, we’ll take a closer look at American Airlines and help you determine whether it’s a smart investment opportunity.

Contents

- Is American Airlines Good to Invest in?

- Frequently Asked Questions

- What are the factors to consider before investing in American Airlines?

- What is the current financial performance of American Airlines?

- What is American Airlines doing to adjust to the impact of the pandemic on the aviation industry?

- What are the risks of investing in American Airlines?

- What is the outlook for American Airlines?

- Is American airline a good stock to buy?

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

Is American Airlines Good to Invest in?

American Airlines is one of the largest airlines in the world, serving millions of passengers each year. The airline has faced numerous challenges in recent years, including increased competition, rising fuel costs, and the COVID-19 pandemic. Despite these challenges, many investors are still considering American Airlines as a potential investment opportunity. In this article, we will take a closer look at the company and examine whether it is a wise investment choice.

Company Overview

American Airlines, also known as American, is a major airline headquartered in Fort Worth, Texas. The airline operates a fleet of over 1,000 aircraft and serves more than 350 destinations in over 50 countries worldwide. American is a founding member of the oneworld alliance and has partnerships with several other airlines, including British Airways, Qantas, and Japan Airlines.

One of the strengths of American Airlines is its extensive route network. The airline has a strong presence in both domestic and international markets, making it an attractive choice for travelers. American also has a well-established frequent flyer program, AAdvantage, which allows customers to earn and redeem miles for flights, hotels, and other travel-related expenses.

However, American Airlines has faced several challenges in recent years. The airline has struggled to maintain profitability due to increased competition from low-cost carriers and rising fuel costs. In addition, the COVID-19 pandemic has had a significant impact on the company’s operations, with many flights canceled and revenue plummeting.

Financial Performance

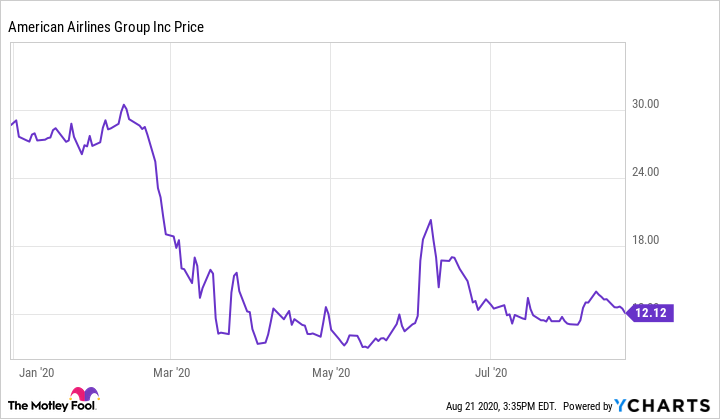

When considering whether to invest in American Airlines, it is important to look at the company’s financial performance. In 2020, the airline reported a net loss of $8.9 billion due to the COVID-19 pandemic. This was a significant decrease from the $1.7 billion in net income the company reported in 2019.

Despite this, American Airlines has taken steps to improve its financial position. The company has reduced its operating expenses and raised additional capital through the sale of bonds and stock offerings. American has also received support from the federal government through the CARES Act, which provided financial assistance to airlines impacted by the pandemic.

Benefits of Investing in American Airlines

One potential benefit of investing in American Airlines is the company’s strong brand recognition. American is a well-known and respected brand in the airline industry, which could help attract customers and generate revenue. Additionally, the airline has a large fleet of aircraft and an extensive route network, which could provide a competitive advantage over other airlines.

Another potential benefit is the potential for the airline industry to recover from the COVID-19 pandemic. As vaccines become more widely available and travel restrictions are lifted, there may be an increase in demand for air travel. This could lead to a rebound in revenue for American Airlines and other airlines in the industry.

Drawbacks of Investing in American Airlines

One major drawback of investing in American Airlines is the company’s financial performance in recent years. The airline has struggled to maintain profitability due to increased competition and rising costs, and the COVID-19 pandemic has only made these challenges more difficult.

In addition, the airline industry is subject to numerous external factors that can impact performance, such as changes in fuel prices, weather events, and geopolitical events. This can make investing in airlines a risky proposition, as there are many variables that are outside of the company’s control.

American Airlines vs. Competitors

When considering whether to invest in American Airlines, it is important to compare the company to its competitors. One major competitor is Delta Air Lines, which is also a major airline with a strong brand and extensive route network. Delta has also been impacted by the COVID-19 pandemic, reporting a net loss of $12.4 billion in 2020.

Another major competitor is Southwest Airlines, which is a low-cost carrier that has been able to maintain profitability in recent years. Southwest has a strong brand and a loyal customer base, but its route network is not as extensive as American or Delta.

Conclusion

In conclusion, investing in American Airlines is a complex decision that requires careful consideration of the company’s financial performance, industry trends, and external factors. While the airline has faced significant challenges in recent years, it also has several strengths, such as its extensive route network and strong brand recognition. Ultimately, whether American Airlines is a good investment choice depends on your individual financial goals and risk tolerance.

Frequently Asked Questions

What are the factors to consider before investing in American Airlines?

Investing in American Airlines requires careful analysis and consideration of certain factors. Firstly, it is important to evaluate the company’s financial performance and stability. This includes looking at its revenue, profitability, and debt levels. Secondly, assessing the company’s competitive position within the industry is crucial. This involves analyzing its market share and ability to compete with other airlines. Lastly, keeping an eye on any external factors that could affect the company’s performance, such as changes in fuel prices or government regulations, is also important.

Overall, before investing in American Airlines, it is essential to conduct thorough research and analysis to ensure it aligns with your investment goals and risk tolerance.

What is the current financial performance of American Airlines?

As of the latest financial report, American Airlines reported a net loss of $2.2 billion for the first quarter of 2021. This was largely due to the ongoing impact of the COVID-19 pandemic on the aviation industry. However, the company did see an increase in revenue compared to the previous quarter, with total operating revenues of $4 billion. The company also reported having $17.3 billion in available liquidity, providing some level of financial stability during these uncertain times.

While American Airlines’ financial performance has been significantly impacted by the pandemic, it is important to note that this is a temporary situation and the company has a history of strong financial performance prior to the pandemic.

What is American Airlines doing to adjust to the impact of the pandemic on the aviation industry?

Like many other airlines, American Airlines has had to make significant adjustments to adapt to the impact of the pandemic on the aviation industry. This includes reducing its flight schedule, implementing cost-cutting measures, and securing government aid to help maintain financial stability. The company has also introduced new safety measures to protect passengers and staff, such as requiring face masks and enhanced cleaning procedures.

Looking forward, American Airlines is continuing to adjust its operations to meet changing demand and travel restrictions. This includes adding new routes, increasing its cargo operations, and investing in new technology to enhance the customer experience.

What are the risks of investing in American Airlines?

As with any investment, there are risks associated with investing in American Airlines. One of the biggest risks is the ongoing impact of the COVID-19 pandemic on the aviation industry. This could lead to prolonged periods of low demand and further financial losses for the company. Additionally, American Airlines operates in a highly competitive industry, which could impact its ability to maintain market share and profitability.

Other risks include fluctuations in fuel prices, changes in government regulations, and unexpected events such as natural disasters or terrorist attacks. It is important for investors to carefully consider these risks before investing in American Airlines.

What is the outlook for American Airlines?

The outlook for American Airlines is largely dependent on the ongoing impact of the COVID-19 pandemic on the aviation industry. While the company has been significantly impacted by the pandemic, there are signs of improvement as travel restrictions ease and demand begins to return. Additionally, American Airlines has a strong brand and a history of financial success prior to the pandemic.

Looking forward, the company is continuing to adjust its operations and invest in new technology to enhance the customer experience. While there are risks associated with investing in American Airlines, there are also opportunities for growth and profitability in the long term.

Is American airline a good stock to buy?

In conclusion, investing in American Airlines can be a smart decision for those who are looking for a long-term investment option. The airline industry is expected to grow in the near future, and American Airlines is well-positioned to benefit from this growth. With a strong brand name, a loyal customer base, and a solid financial position, American Airlines is a company that investors can trust.

However, it’s important to remember that investing in any company comes with risks. The airline industry is highly competitive, and there are many factors that can impact American Airlines’ performance, such as fuel costs, labor issues, and global economic conditions. Investors should carefully consider these risks before making any investment decisions.

Overall, while American Airlines may not be the perfect investment option for everyone, it’s certainly worth considering for those looking to diversify their portfolio with a stable and potentially lucrative option. With a strong track record of success, a commitment to innovation, and a focus on delivering value to its customers, American Airlines is a company that has the potential to generate solid returns for investors in the years to come.