Are you planning to book a trip with American Airlines and wondering if trip insurance is worth it? With the uncertainties of travel, it’s wise to consider purchasing trip insurance to protect your investment. American Airlines offers various trip insurance options that cater to different needs. In this article, we’ll explore the benefits of trip insurance and help you decide if it’s worth it for your American Airlines trip.

From flight cancellations to medical emergencies abroad, travel mishaps can happen anytime, anywhere. With trip insurance, you can have peace of mind knowing that you’re covered for unforeseen events that may disrupt your travel plans. American Airlines offers trip insurance options, including trip cancellation/interruption, medical and evacuation, and baggage protection. But are these options worth the extra cost? Let’s dive in and find out.

Contents

- Is Trip Insurance Worth It American Airlines?

- Frequently Asked Questions

- What does trip insurance from American Airlines cover?

- How much does American Airlines trip insurance cost?

- When should I consider purchasing trip insurance from American Airlines?

- What are some common exclusions with American Airlines trip insurance?

- How do I purchase trip insurance from American Airlines?

- Is travel insurance worth it?

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

Is Trip Insurance Worth It American Airlines?

When planning a trip, one of the most important decisions you’ll make is whether or not to purchase trip insurance. This type of insurance can provide peace of mind and financial protection in case unexpected events occur before or during your trip. American Airlines offers trip insurance to its customers, but is it really worth it? Let’s take a closer look.

What is American Airlines Trip Insurance?

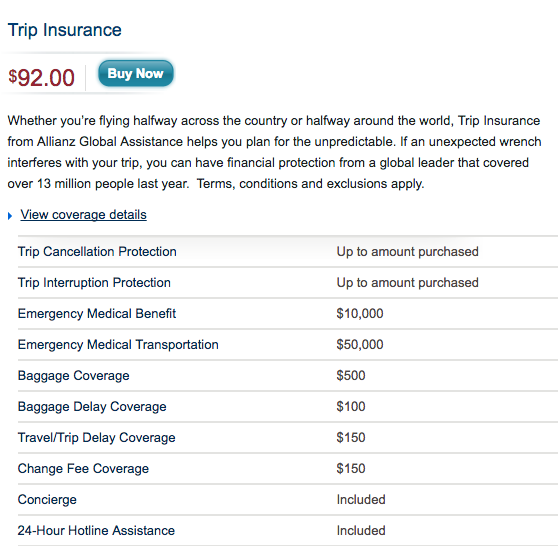

American Airlines offers trip insurance through its partner, Allianz Global Assistance. This insurance can provide coverage for trip cancellation, trip interruption, emergency medical and dental expenses, emergency medical transportation, baggage loss or delay, travel delay, and more.

When you purchase American Airlines trip insurance, you’ll have access to 24-hour emergency assistance services. This can be especially helpful if you’re traveling to a foreign country and need help navigating a medical emergency or other unexpected situation.

Benefits of American Airlines Trip Insurance

One of the biggest benefits of American Airlines trip insurance is the peace of mind it can provide. If you’re spending a lot of money on a trip, you don’t want to risk losing that investment due to unforeseen circumstances. Trip insurance can provide financial protection in case you need to cancel your trip or if something unexpected happens during your travels.

Another benefit of American Airlines trip insurance is the convenience factor. You can purchase the insurance directly through American Airlines when you book your flights, making the process simple and straightforward. You won’t need to shop around for insurance policies or worry about finding coverage that meets your specific needs.

Drawbacks of American Airlines Trip Insurance

One potential drawback of American Airlines trip insurance is the cost. Depending on the coverage you choose, trip insurance can add a significant expense to your travel budget. You’ll need to decide whether the peace of mind and financial protection are worth the extra cost.

Another potential drawback of American Airlines trip insurance is the limitations of coverage. Depending on the policy, there may be certain situations that are not covered, or coverage may be limited in certain circumstances. You’ll need to carefully review the policy details to make sure you understand exactly what is and isn’t covered.

Is American Airlines Trip Insurance Worth It?

Ultimately, whether or not American Airlines trip insurance is worth it will depend on your individual circumstances. If you’re traveling with a lot of expensive equipment, have a pre-existing medical condition, or are traveling during a time when weather is unpredictable, trip insurance can provide valuable protection.

On the other hand, if you’re traveling on a budget and can’t afford to add extra expenses to your travel costs, or if your trip is fairly straightforward and doesn’t involve a lot of high-risk activities or situations, trip insurance may not be necessary.

Conclusion

When deciding whether or not to purchase American Airlines trip insurance, it’s important to carefully consider your individual circumstances and the potential risks involved in your trip. While trip insurance can provide valuable financial protection and peace of mind, it may not be necessary for every traveler. Be sure to review policy details carefully, and consider shopping around for other insurance options to find the coverage that best meets your needs.

Frequently Asked Questions

Going on a trip is already expensive enough, but is it worth it to purchase trip insurance from American Airlines? Here are some common questions and answers to help you make a decision.

What does trip insurance from American Airlines cover?

American Airlines trip insurance can cover a variety of things such as trip cancellations, trip interruptions, medical emergencies, and lost or delayed baggage. It can also provide assistance if you miss a flight or need emergency medical transportation.

It’s important to note that coverage may vary depending on the specific policy you choose and any exclusions that apply.

How much does American Airlines trip insurance cost?

The cost of trip insurance from American Airlines varies depending on factors such as the length of your trip, your age, and the level of coverage you choose. Typically, it ranges from a few dollars to several hundred dollars.

Before purchasing trip insurance, be sure to read the policy carefully and understand what is covered and what is not. You may also want to compare prices with other insurance providers to ensure you are getting the best value.

When should I consider purchasing trip insurance from American Airlines?

You may want to consider purchasing trip insurance from American Airlines if you have a non-refundable ticket, are traveling internationally, or have a pre-existing medical condition. It can also be helpful if you are traveling during a peak travel season or to a destination with a high risk of natural disasters.

Ultimately, the decision to purchase trip insurance is a personal one and depends on your individual circumstances and risk tolerance.

What are some common exclusions with American Airlines trip insurance?

Some common exclusions with American Airlines trip insurance include pre-existing medical conditions, acts of war or terrorism, and extreme sports or activities. It’s important to carefully read the policy and understand any exclusions before purchasing trip insurance.

If you have a pre-existing medical condition, you may be able to purchase a policy with a pre-existing condition waiver, but it may come at an additional cost.

How do I purchase trip insurance from American Airlines?

You can purchase trip insurance from American Airlines during the booking process or by visiting their website. Be sure to carefully review the policy details and understand the coverage and exclusions before purchasing.

If you have any questions or concerns, you can also contact American Airlines customer service for assistance.

Is travel insurance worth it?

In conclusion, whether or not trip insurance is worth it for American Airlines depends on individual circumstances and preferences. If you are someone who values peace of mind and wants to protect your investment in your trip, trip insurance may be a wise choice. However, if you are comfortable taking on the risks and costs associated with potential trip disruptions or cancellations, you may decide to forego trip insurance.

It’s important to carefully review the terms and conditions of any trip insurance policy before making a decision. Be sure to understand what is covered, as well as any exclusions or limitations. Additionally, consider the cost of the trip insurance and how it fits into your overall travel budget.

Ultimately, the decision to purchase trip insurance for American Airlines or any other airline is up to you. By weighing the potential benefits and costs, you can make an informed decision that aligns with your travel goals and preferences.