Traveling can be an exciting experience, but it’s always better to have some peace of mind while you’re on the go. American Airlines offers flight insurance to its passengers to protect them from unforeseen circumstances. But what exactly does this insurance cover? In this article, we’ll take a closer look at the coverage provided by American Airlines flight insurance so you can make an informed decision before your next flight.

What Does American Airlines Flight Insurance Cover?

When it comes to protecting yourself and your loved ones while traveling, flight insurance is an essential consideration. American Airlines offers flight insurance to provide peace of mind and financial protection for unexpected events that could occur while flying. But what does American Airlines flight insurance cover? Let’s take a closer look.

Accidental Death and Dismemberment Coverage

Accidental death and dismemberment coverage is a type of insurance that pays benefits if the policyholder dies or is seriously injured in an accident. American Airlines flight insurance provides coverage for accidental death and dismemberment, which means that if the worst happens, your loved ones will receive a lump sum payment to help cover expenses.

This coverage is particularly important if you are traveling with dependents or if you are the primary earner in your household. Accidents can happen at any time, and having this coverage can help protect your family from financial hardship in the event of a tragedy.

Trip Cancellation and Interruption Coverage

Trip cancellation and interruption coverage are designed to provide financial protection if you need to cancel or interrupt your trip due to unexpected events. American Airlines flight insurance provides coverage for trip cancellation and interruption, which means that if you need to cancel or cut your trip short due to a covered event, you will be reimbursed for your non-refundable expenses.

Covered events may include illness, injury, severe weather, or other unforeseen circumstances that prevent you from traveling as planned. This coverage can provide peace of mind and financial protection, especially if you have invested a significant amount of money in your trip.

Baggage Delay and Loss Coverage

Baggage delay and loss coverage are designed to provide compensation if your luggage is delayed, lost, or damaged during your trip. American Airlines flight insurance provides coverage for baggage delay and loss, which means that if your luggage is delayed, lost, or damaged, you will be reimbursed for the cost of replacing essential items.

This coverage can be particularly helpful if you are traveling with expensive or irreplaceable items, such as electronics, jewelry, or important documents. It can also provide peace of mind knowing that you will be reimbursed for the cost of replacing your belongings if they are lost or damaged during your trip.

Medical and Dental Coverage

Medical and dental coverage is designed to provide financial protection if you become ill or injured during your trip. American Airlines flight insurance provides coverage for medical and dental expenses, which means that if you need medical or dental treatment while traveling, your expenses will be covered.

This coverage can be particularly important if you are traveling to a foreign country where medical care may be expensive or difficult to access. It can also provide peace of mind knowing that you will be covered if you become ill or injured while traveling.

24-Hour Assistance Services

American Airlines flight insurance also provides 24-hour assistance services to help you with travel-related emergencies. These services include emergency medical and dental referrals, travel assistance, and emergency cash transfers.

If you need help while traveling, you can contact the 24-hour assistance services for assistance. This can provide peace of mind knowing that you have access to help whenever you need it.

Benefits of American Airlines Flight Insurance

There are several benefits of purchasing American Airlines flight insurance. Some of the key benefits include:

- Peace of mind knowing that you are protected from unexpected events while traveling

- Financial protection for you and your loved ones in the event of a tragedy

- Reimbursement for non-refundable expenses if you need to cancel or interrupt your trip

- Compensation for delayed, lost, or damaged luggage

- Coverage for medical and dental expenses while traveling

- 24-hour assistance services for travel-related emergencies

American Airlines Flight Insurance vs. Other Travel Insurance Options

While American Airlines flight insurance provides comprehensive coverage for unexpected events while traveling, there are other travel insurance options available. Some of the key differences between American Airlines flight insurance and other travel insurance options include:

| American Airlines Flight Insurance | Other Travel Insurance Options |

|---|---|

| Provides coverage specifically for American Airlines flights | May provide coverage for multiple airlines and travel providers |

| May be more expensive than other travel insurance options | May be more affordable than American Airlines flight insurance |

| Provides 24-hour assistance services for travel-related emergencies | May or may not provide 24-hour assistance services |

Ultimately, the best travel insurance option for you will depend on your specific needs and circumstances. It is important to carefully evaluate your options and choose a policy that provides the coverage and benefits that are most important to you.

Conclusion

American Airlines flight insurance provides comprehensive coverage for unexpected events while traveling, including accidental death and dismemberment, trip cancellation and interruption, baggage delay and loss, medical and dental expenses, and 24-hour assistance services. While there are other travel insurance options available, American Airlines flight insurance can provide peace of mind and financial protection for American Airlines flights.

Contents

- Frequently Asked Questions

- What is American Airlines Flight Insurance?

- Does American Airlines Flight Insurance cover flight cancellations?

- What happens if my baggage is lost or damaged during my flight?

- Does American Airlines Flight Insurance cover medical expenses?

- What other coverage does American Airlines Flight Insurance provide?

- Travel insurance: What it covers, what it doesn’t

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

Frequently Asked Questions

What is American Airlines Flight Insurance?

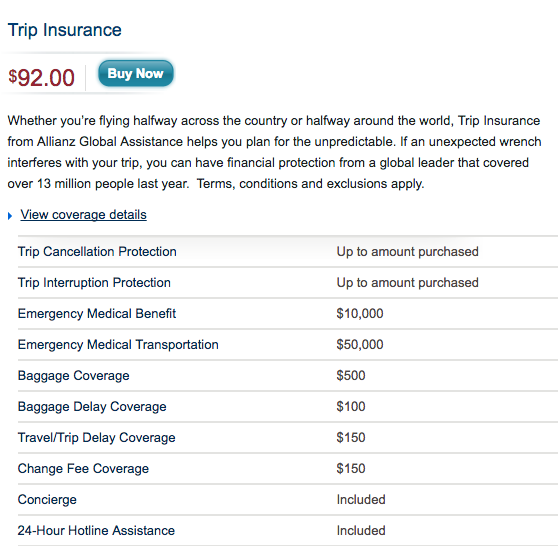

American Airlines Flight Insurance is a type of travel insurance that provides coverage for unexpected events that may happen during your trip. This insurance covers flight cancellations, delays, lost or damaged baggage, medical expenses, and other unforeseen circumstances that may occur while you are traveling.

The insurance is available for purchase when you book your flight on the American Airlines website or through the American Airlines Reservations hotline. The cost of the insurance varies depending on the trip’s duration and the type of coverage you choose.

Does American Airlines Flight Insurance cover flight cancellations?

Yes, American Airlines Flight Insurance covers flight cancellations due to unexpected events such as illness, severe weather, or other unforeseen circumstances. If your flight is canceled, the insurance will provide you with a full refund for your ticket and any other services you have purchased through American Airlines, including hotel reservations and car rentals.

The insurance also covers the cost of rebooking your flight and any additional expenses you may incur due to the cancellation, such as meals and accommodations.

What happens if my baggage is lost or damaged during my flight?

If your baggage is lost or damaged during your flight, American Airlines Flight Insurance will provide coverage for the cost of replacing or repairing your belongings. The insurance will also cover any additional expenses you may incur due to the loss or damage, such as the cost of purchasing new clothes or personal items.

To file a claim for lost or damaged baggage, you must contact American Airlines customer service within 24 hours of your arrival at your destination. You will need to provide documentation of the loss or damage, such as a baggage claim form or a police report.

Does American Airlines Flight Insurance cover medical expenses?

Yes, American Airlines Flight Insurance provides coverage for medical expenses that may arise during your trip. If you become ill or injured while traveling, the insurance will cover the cost of medical treatment, hospitalization, and emergency evacuation if necessary.

The insurance also provides coverage for accidental death and dismemberment, which pays a benefit to your beneficiaries if you die or suffer a serious injury during your trip.

What other coverage does American Airlines Flight Insurance provide?

American Airlines Flight Insurance provides coverage for a variety of other unexpected events that may occur during your trip. This includes coverage for trip interruption, trip delay, and missed connections due to events such as severe weather, natural disasters, or transportation strikes.

The insurance also provides 24/7 travel assistance services, including emergency medical and legal assistance, travel document replacement, and emergency cash transfers. These services are available to you wherever you are in the world, and you can access them by calling the American Airlines Flight Insurance hotline.

Travel insurance: What it covers, what it doesn’t

In conclusion, American Airlines Flight Insurance is an excellent option for passengers who want to protect themselves against unforeseen circumstances. The insurance policy covers various scenarios, including trip cancellations, delays, and lost or damaged baggage. Additionally, the policy offers medical coverage for injuries sustained during the flight or while traveling to and from the airport.

It is important to note that the coverage provided by American Airlines Flight Insurance may vary depending on the type of plan purchased. Passengers are advised to review the policy details carefully to ensure that they are fully covered. Overall, American Airlines Flight Insurance is a great investment for anyone who values peace of mind when traveling.

If you are planning a trip soon, consider purchasing American Airlines Flight Insurance to protect yourself from unexpected situations. With its comprehensive coverage and affordable rates, you can travel with confidence and ease. Don’t let the fear of the unknown keep you from exploring new destinations – invest in American Airlines Flight Insurance today and enjoy worry-free travel!