United Airlines is one of the most popular airlines in the world, offering its customers a variety of services and amenities. In addition to flights, United Airlines also offers insurance coverage to protect their customers during their travels. But what exactly does United Airlines Insurance cover? Let’s find out.

From trip cancellation to lost baggage, United Airlines Insurance offers a range of coverage options for travelers. This insurance can provide peace of mind to those who are concerned about unexpected expenses or situations that may arise during their journey. Keep reading to learn more about the specific coverage options offered by United Airlines Insurance.

Contents

- What Does United Airlines Insurance Cover?

- Frequently Asked Questions

- What is United Airlines Insurance?

- What does United Airlines Insurance cover?

- How do I purchase United Airlines Insurance?

- What is not covered by United Airlines Insurance?

- How do I file a claim with United Airlines Insurance?

- Travel insurance: What it covers, what it doesn’t

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

What Does United Airlines Insurance Cover?

United Airlines offers a range of insurance options for their customers, each with its own unique coverage and benefits. These insurance plans are designed to provide peace of mind to customers who want to protect themselves and their travels against unforeseen events. Here’s what you need to know about United Airlines insurance coverage.

Flight Cancellation and Change Coverage

United Airlines offers travel insurance that provides coverage for flight cancellations and changes. This insurance policy is designed to protect customers against unexpected events that may lead to the cancellation or change of their flights. The policy covers cancellations and changes due to illness, injury, death, or severe weather conditions. Customers who purchase this insurance policy can change or cancel their flights without incurring any additional fees.

The insurance policy also covers expenses incurred due to flight delays, including accommodations, meals, and transportation. Customers who experience flight delays of more than 12 hours are eligible for reimbursement of up to $500 per day for expenses incurred during the delay.

Baggage Coverage

United Airlines insurance also provides coverage for baggage loss, damage, or delay. This policy covers the cost of replacing lost or damaged baggage, as well as the cost of purchasing essential items if baggage is delayed for more than 24 hours. The policy also covers the cost of shipping baggage if it is lost or delayed.

Customers who purchase this insurance policy are eligible for up to $3,000 in coverage for lost, damaged, or delayed baggage. The policy also provides coverage for personal items such as laptops, cameras, and other electronics.

Medical Coverage

United Airlines offers medical coverage for customers who become ill or injured while traveling. This insurance policy provides coverage for medical expenses incurred during the trip, including hospitalization, emergency medical treatment, and transportation to a medical facility.

Customers who purchase this insurance policy are eligible for up to $50,000 in coverage for medical expenses incurred during their trip. The policy also provides coverage for emergency medical evacuation if necessary.

Accidental Death and Dismemberment Coverage

United Airlines insurance also provides accidental death and dismemberment coverage for customers who experience an accident while traveling. This insurance policy provides coverage for accidental death or dismemberment that occurs during the trip.

Customers who purchase this insurance policy are eligible for up to $500,000 in coverage for accidental death or dismemberment during their trip.

Travel Assistance Services

In addition to insurance coverage, United Airlines also offers travel assistance services to its customers. These services include emergency travel assistance, medical assistance, legal assistance, and language translation services.

Customers who experience an emergency while traveling can contact the travel assistance services for help with medical referrals, transportation, and accommodations. The services also provide access to legal and language translation assistance if needed.

Benefits of United Airlines Insurance

The benefits of United Airlines insurance include peace of mind, protection against unexpected events, and financial security. Customers who purchase insurance coverage can travel with confidence knowing that they are protected against unforeseen events.

The insurance policies also provide financial security by reimbursing customers for expenses incurred due to flight cancellations, delays, lost or damaged baggage, and medical expenses incurred during the trip.

United Airlines Insurance Vs. Third-Party Insurance

While United Airlines offers insurance coverage for its customers, third-party insurance providers also offer travel insurance policies. The main difference between United Airlines insurance and third-party insurance is the coverage options and benefits offered.

United Airlines insurance policies are designed to provide coverage for specific events, such as flight cancellations, baggage loss, and medical emergencies. Third-party insurance providers offer more comprehensive coverage options, including trip cancellation, trip interruption, and emergency medical evacuation.

How to Purchase United Airlines Insurance

Customers can purchase United Airlines insurance when booking their flights online or through the United Airlines mobile app. Insurance policies can also be purchased by calling United Airlines customer service or at the airport.

Conclusion

United Airlines insurance coverage provides peace of mind and financial security for customers who want to protect themselves and their travels against unforeseen events. The insurance policies offer coverage for flight cancellations, baggage loss, medical emergencies, accidental death and dismemberment, and travel assistance services. Customers can purchase insurance policies when booking their flights online or through the United Airlines mobile app.

Frequently Asked Questions

Here are some common questions regarding United Airlines Insurance coverage:

What is United Airlines Insurance?

United Airlines Insurance is a type of travel insurance that is offered by United Airlines to provide coverage for unexpected events that may occur while traveling. This insurance is designed to provide financial protection to passengers for things like trip cancellations, delays, lost or delayed baggage, and medical emergencies.

The insurance can be purchased at the time of booking a flight, and it provides coverage for the duration of the trip.

What does United Airlines Insurance cover?

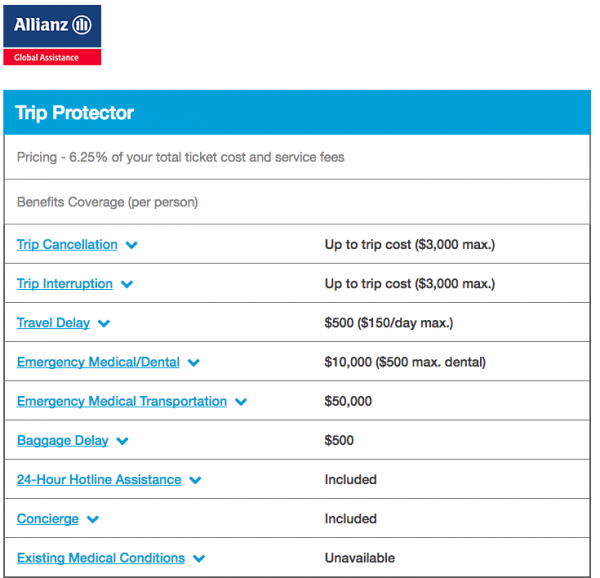

United Airlines Insurance covers a range of unexpected events that may occur while traveling. These include trip cancellations, trip interruptions, delays, lost or delayed baggage, and medical emergencies. The insurance also provides coverage for emergency medical and dental expenses, emergency medical transportation, and accidental death and dismemberment.

It is important to note that the coverage provided by United Airlines Insurance may vary depending on the specific plan purchased. Passengers should review the terms and conditions of their policy to understand what is covered.

How do I purchase United Airlines Insurance?

United Airlines Insurance can be purchased at the time of booking a flight on the United Airlines website or through a travel agent. Passengers can choose from a range of coverage options, including basic, standard, and deluxe plans. The cost of the insurance will depend on the level of coverage selected and the length of the trip.

Passengers can also purchase United Airlines Insurance after booking a flight by visiting the airline’s website and providing their reservation information.

What is not covered by United Airlines Insurance?

While United Airlines Insurance provides comprehensive coverage for unexpected events that may occur while traveling, there are some situations that are not covered by the policy. These include pre-existing medical conditions, acts of war or terrorism, and reckless behavior. Passengers should review the terms and conditions of their policy to understand what is not covered.

It is also important to note that United Airlines Insurance does not provide coverage for trip cancellations or interruptions due to natural disasters, such as hurricanes or earthquakes.

How do I file a claim with United Airlines Insurance?

If an unexpected event occurs while traveling and a passenger needs to file a claim with United Airlines Insurance, they should contact the insurance provider as soon as possible. Passengers can file a claim online or by phone, and they will need to provide documentation to support their claim.

The documentation required may vary depending on the type of claim being filed. For example, if a passenger is filing a claim for lost or delayed baggage, they may need to provide a copy of their baggage claim ticket and proof of the value of the lost or delayed items.

Travel insurance: What it covers, what it doesn’t

In conclusion, United Airlines offers a range of insurance options to ensure that passengers have a stress-free travel experience. The airline offers trip cancellation and interruption insurance, baggage insurance, and accidental death and dismemberment insurance. With these policies, passengers can have peace of mind knowing that they are covered in case of unforeseen circumstances.

The trip cancellation and interruption insurance covers travelers in case they need to cancel or reschedule their trip due to unforeseen circumstances such as illness, injury, or a natural disaster. This policy provides reimbursement for non-refundable expenses such as airfare, hotel reservations, and tour packages.

Baggage insurance covers passengers in case their baggage is lost, damaged, or delayed during their trip. The policy provides reimbursement for the cost of replacing essential items such as clothing, toiletries, and medication.

Accidental death and dismemberment insurance provides coverage in case of a fatal accident or severe injury during the flight. This policy provides financial compensation to the passenger’s family or beneficiaries in case of the worst-case scenario.

Overall, United Airlines insurance options provide travelers with the peace of mind they need to enjoy their trip without worrying about unexpected events. It is always recommended to carefully review the policy details and understand the coverage limits before purchasing insurance.