United Airlines offers Travel Guard insurance to protect travelers from unexpected events during their trip. But what exactly does this insurance cover? Let’s explore the benefits and coverage provided by United Airlines Travel Guard insurance.

Whether it’s a canceled flight, lost baggage, or a medical emergency, United Airlines Travel Guard insurance can give travelers peace of mind while on the go. With various levels of coverage available, it’s important to understand what is covered and what isn’t before purchasing the insurance.

Contents

- What Does United Airlines Travel Guard Insurance Cover?

- Trip Cancellation Coverage

- Baggage Coverage

- Medical Coverage

- Accidental Death and Dismemberment Coverage

- 24-Hour Emergency Assistance

- Rental Car Damage Coverage

- Sports Equipment Coverage

- Pre-Existing Medical Conditions Coverage

- Benefits of United Airlines Travel Guard Insurance

- United Airlines Travel Guard Insurance Vs Other Insurance Plans

- Frequently Asked Questions

- Does United Airlines Travel Guard Insurance cover trip cancellation?

- Will United Airlines Travel Guard Insurance cover me if I get sick while traveling?

- Does United Airlines Travel Guard Insurance cover lost or delayed baggage?

- Will United Airlines Travel Guard Insurance cover me if I have a travel accident?

- Does United Airlines Travel Guard Insurance cover trip interruption?

- Travel insurance: What it covers, what it doesn’t

- How Many Aircraft Does American Airlines Have?

- Is American Airlines Business Class Worth It?

- Can You Have 2 Carry Ons For American Airlines?

What Does United Airlines Travel Guard Insurance Cover?

United Airlines is a leading airline company that offers a variety of travel insurance options to its passengers. Travel Guard is one such insurance plan that is designed to protect travelers from any unforeseen circumstances that may arise during their journey. This insurance plan covers a range of different issues that could potentially affect your travel plans. In this article, we will discuss the different aspects of United Airlines Travel Guard Insurance coverage.

Trip Cancellation Coverage

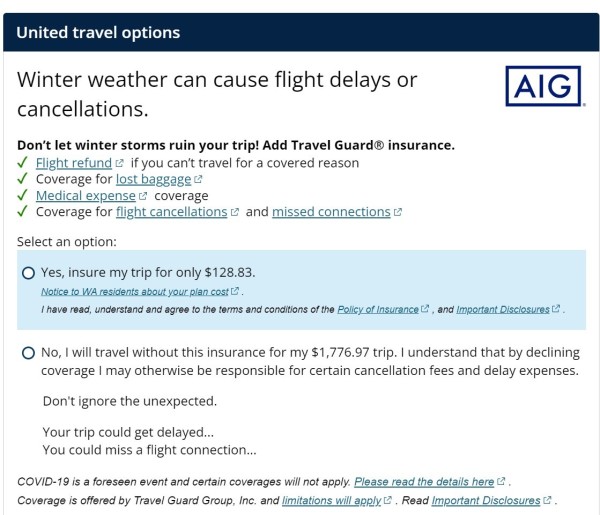

Trip cancellations can be a major inconvenience for travelers. United Airlines Travel Guard Insurance covers trip cancellations due to unforeseen events such as illness, injury, or death of the traveler or a family member, natural disasters, and other similar reasons. The insurance also covers trip interruption, which includes expenses incurred while returning home due to an emergency.

The insurance plan also includes trip delay coverage, which covers additional expenses incurred due to a delayed flight. This may include meals, accommodation, and transportation expenses.

Baggage Coverage

Losing your baggage during travel can be a nightmare for any traveler. United Airlines Travel Guard Insurance covers lost, stolen, or damaged baggage during your journey. The insurance plan also covers the cost of purchasing necessary items that were lost with the baggage.

Medical Coverage

Medical emergencies during travel can be very expensive. United Airlines Travel Guard Insurance includes medical coverage, which covers medical expenses incurred while traveling. This includes emergency medical treatment, hospitalization, and emergency dental treatment.

The insurance plan also includes medical evacuation coverage, which covers the cost of transporting the traveler to a medical facility in case of a medical emergency.

Accidental Death and Dismemberment Coverage

In the unfortunate event of an accident during travel, United Airlines Travel Guard Insurance covers accidental death and dismemberment. The insurance plan provides a lump sum payment to the beneficiary in case of death or dismemberment due to an accident.

24-Hour Emergency Assistance

United Airlines Travel Guard Insurance also includes 24-hour emergency assistance services. These services include emergency travel assistance, medical assistance, and emergency cash transfers. The assistance services are available to the insured person throughout their journey.

Rental Car Damage Coverage

If you are planning to rent a car during your travel, United Airlines Travel Guard Insurance also covers rental car damage. The insurance plan covers the cost of repairing or replacing a rental car in case of damage or theft.

Sports Equipment Coverage

If you are planning to travel with sports equipment such as golf clubs or skis, United Airlines Travel Guard Insurance covers the loss, theft, or damage of sports equipment during travel. The insurance plan also covers the cost of renting replacement sports equipment if necessary.

Pre-Existing Medical Conditions Coverage

If you have pre-existing medical conditions, United Airlines Travel Guard Insurance covers medical expenses related to these conditions during travel. However, certain terms and conditions apply, and it is important to read the insurance policy carefully to understand the coverage.

Benefits of United Airlines Travel Guard Insurance

The benefits of United Airlines Travel Guard Insurance include peace of mind during travel, as well as protection against unforeseen circumstances that could potentially ruin your journey. The insurance plan provides coverage for a wide range of issues, including trip cancellations, medical emergencies, lost baggage, and rental car damage.

United Airlines Travel Guard Insurance Vs Other Insurance Plans

Compared to other insurance plans, United Airlines Travel Guard Insurance offers comprehensive coverage for a variety of issues that could potentially affect your journey. The insurance plan is designed specifically for travelers and provides a range of benefits that are tailored to the needs of travelers.

In conclusion, United Airlines Travel Guard Insurance is a worthwhile investment for anyone who is planning to travel. The insurance plan provides comprehensive coverage for a variety of issues that could potentially affect your journey, including trip cancellations, medical emergencies, lost baggage, and rental car damage. The benefits of the insurance plan include peace of mind during travel and protection against unforeseen circumstances that could ruin your journey.

Frequently Asked Questions

Does United Airlines Travel Guard Insurance cover trip cancellation?

Yes, United Airlines Travel Guard Insurance covers trip cancellation. This means that if you have to cancel your trip due to a covered reason, such as an illness, injury, or death of a family member, you can receive reimbursement for your non-refundable trip expenses up to the limit of your policy.

It’s important to note that not all reasons for canceling a trip are covered, and there may be exclusions and limitations in your policy. Be sure to read the terms and conditions carefully before purchasing United Airlines Travel Guard Insurance.

Will United Airlines Travel Guard Insurance cover me if I get sick while traveling?

Yes, United Airlines Travel Guard Insurance provides coverage for medical expenses if you get sick while traveling. This includes coverage for emergency medical and dental expenses, as well as medical evacuation and repatriation of remains.

It’s important to note that pre-existing conditions may be excluded from coverage, and there may be limitations and exclusions in your policy. Be sure to read the terms and conditions carefully before purchasing United Airlines Travel Guard Insurance.

Does United Airlines Travel Guard Insurance cover lost or delayed baggage?

Yes, United Airlines Travel Guard Insurance provides coverage for lost or delayed baggage. This includes reimbursement for the value of your lost or stolen luggage, as well as coverage for expenses incurred due to delayed baggage, such as the purchase of clothing and toiletries.

It’s important to note that there may be limitations and exclusions in your policy, and you will need to file a claim with the airline and/or baggage handler before seeking reimbursement from United Airlines Travel Guard Insurance.

Will United Airlines Travel Guard Insurance cover me if I have a travel accident?

Yes, United Airlines Travel Guard Insurance provides coverage for travel accidents. This includes coverage for accidental death and dismemberment, as well as coverage for injuries sustained in a travel accident.

It’s important to note that there may be limitations and exclusions in your policy, and coverage may be secondary to any other insurance you have. Be sure to read the terms and conditions carefully before purchasing United Airlines Travel Guard Insurance.

Does United Airlines Travel Guard Insurance cover trip interruption?

Yes, United Airlines Travel Guard Insurance covers trip interruption. This means that if your trip is interrupted due to a covered reason, such as an illness or injury, you can receive reimbursement for your non-refundable trip expenses up to the limit of your policy.

It’s important to note that not all reasons for interrupting a trip are covered, and there may be exclusions and limitations in your policy. Be sure to read the terms and conditions carefully before purchasing United Airlines Travel Guard Insurance.

Travel insurance: What it covers, what it doesn’t

In conclusion, United Airlines Travel Guard Insurance is an excellent way to protect your travel investment. With coverage for trip cancellation, interruption, delay, and baggage loss or damage, you can rest easy knowing that you’re covered in case of unexpected events.

Additionally, the insurance also provides 24/7 emergency assistance, medical expense coverage, and accidental death and dismemberment coverage. This ensures that you have the necessary support and financial protection in case of a medical emergency while traveling.

Overall, United Airlines Travel Guard Insurance offers comprehensive coverage and peace of mind for travelers. It’s important to review the specific policy details and exclusions before purchasing to ensure that it meets your individual needs and preferences. Don’t let unexpected events ruin your travel plans – consider purchasing United Airlines Travel Guard Insurance today.